How can there be a record number of homeless and a booming housing market? It’s almost unbelievable that one sector of our economy is growing like in the good old days of the early 2000s when the housing bubble was formed, while a huge number of foreclosures and evictions are looming by the end of the year due to the pandemic.

There aren’t enough houses on the market or being built to satisfy the incredible demand, as home buyers that can afford to are again moving as they did during the housing bubble into larger homes in what they consider to be suburbs safer from COVID-19 infection.

And conditions are different this time. Builders will have a difficulty building enough housing because of the pandemic that is causing a material and skilled-worker shortage. Hence there is a looming housing shortage for those impacted most by the pandemic.

Existing-home sales grew for the fifth consecutive month in October to a seasonally-adjusted annual rate of 6.85 million – up 4.3 percent from the prior month and 26.6% from one year ago, according to the National Association of Realtors.

- The median existing-home price was $313,000, almost 16 percent more than in October 2019. Total housing inventory declined from the prior month and one year ago to 1.42 million, enough to last 2.5 months – a record low – at the current sales pace.

- More than 7 in 10 homes sold in October 2020 – 72 percent – were on the market for less than a month.

NAR chief economist Lawrence Yun made the understatement of the year when he said, "Considering that we remain in a period of stubbornly high unemployment relative to pre-pandemic levels, the housing sector has performed remarkably well this year.”

This is while more than 12 million workers employed before the pandemic are still without work, and almost 20 million still receive unemployment compensation from various government programs that they would not have received during an ordinary recession.

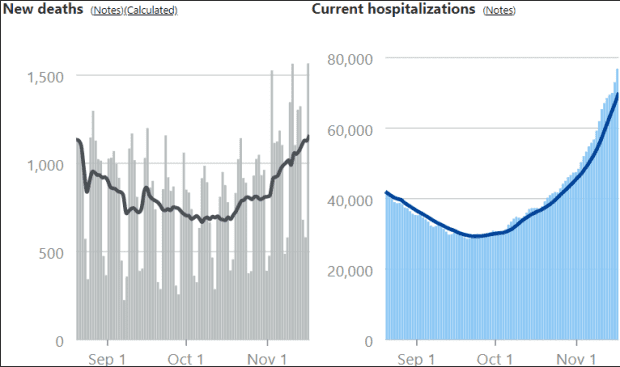

And this isn’t an ordinary recession. Some economists are beginning to fear a continuation of the pandemic-induced recession with the rising coronavirus death toll, as I said yesterday. While the U.S. makes up 4 percent of the world’s population, it has had 20 percent of all COVID-19 cases. As of Wednesday, the U.S. had reported 11 million coronavirus cases and 248,687 COVID-19-related deaths, just ahead of India (8.9 million cases to date), according to Johns Hopkins University.

Home builders are rushing to fill the demand, with single-family starts up 6.4 percent to a 13-year high and multi-family starts unchanged from an upward-revised September level, according to the National Association of Home Builders (NAHB). Overall starts rose 4.9 percent and the level of 1.530 million was as expected.

“As seen in the NAHB/Wells Fargo builder confidence index, single-family starts continue to grow off a historic rebound that began in April,” said NAHB Chairman Chuck Fowke. “Current demand is being supported by historically low interest rates and home buyer preferences shifting to the suburbs and exurbs.”

This is the fastest growth in new residential construction since 2007.

It’s almost surreal that parts of the US economy continue to grow during what looks to be a very dark winter for those that may be without jobs or homeless with the expiration of eviction bans and foreclosures scheduled to end in December 31.

The US is currently under a national eviction moratorium that stops landlords from evicting tenants who don't pay rent until at least Dec. 31, 2020. Although the previous eviction ban that was part of the CARES Act only covered certain properties, this current moratorium effectively protects everyone living in one of the nation's roughly 43 million rental households, regardless of the kind of building they live in.

So the housing shortage is more than a lack of inventory for available homebuyers. Conditions will become something much worse if existing homeowners and renters aren’t allowed to remain in their homes until the pandemic ends.

Harlan Green © 2020

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen