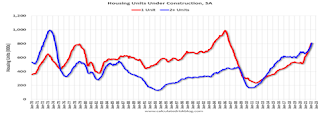

Calculated Risk’s Bill McBride says the most residential units are under construction since 1973, as can be seen in his Calculated Risk graph.

“Combined, there are 1.622 million units under construction. It is the most since February 1973, when a record 1.628 million units were under construction (mostly apartments in 1973 for the baby boom generation).”

And privately‐owned housing starts (new construction) in March of this year were at a seasonally adjusted annual rate of 1,793,000, which should keep builders and homebuyers satisfied for the rest of this year, at least.

New starts are 0.3 percent above the revised February estimate of 1,788,000 and 3.9 percent above the March 2021 rate of 1,725,000. Single‐family housing starts in March were at a rate of 1,200,000; this is 1.7 percent below the revised February figure of 1,221,000. The March rate for units in buildings with five units or more was 574,000.

Housing construction should now begin to catch up to demand. Many of the single-family and rental unit completions were held up by supply delays during the pandemic that are finally beginning to ease as the pandemic has eased.

Builder confidence is still high for newly built single-family homes, though it moved two points lower to 77 in April, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the fourth straight month that builder sentiment has declined, but it is still above the 60s index confidence levels that prevailed in earlier decades.

But there are still problems with rising interest rates that makes everything more expensive and knocks many first-time buyers out of the housing market with limited incomes.

“The housing market faces an inflection point as an unexpectedly quick rise in interest rates, rising home prices and escalating material costs have significantly decreased housing affordability conditions, particularly in the crucial entry-level market,” said NAHB Chief Economist Robert Dietz.

Mortgage interest rates have jumped more than 1.9 percentage points since the start of the year and currently stand at 5 percent, the highest level in more than a decade, as can be seen with the FRED graph of historical 30-yr conforming fixed rates. They were as low as 2.5 percent in the past 2 years during the pandemic.

This is while existing-home sales decreased 2.7 percent between February and March, dropping to a seasonally-adjusted, annual rate of 5.77 million, the National Association of Realtors said Wednesday. It was the second consecutive month in which sales fell. Compared to a year ago, sales were down 4.5 percent.

“The housing market is starting to feel the impact of sharply rising mortgage rates and higher inflation taking a hit on purchasing power,” Lawrence Yun, chief economist for the National Association of Realtors, said in the report. “Still, homes are selling rapidly, and home price gains remain in the double-digits.”

Yun now predicts that home sales will contract by 10 percent in 2022, as surging mortgage rates curb home-buying demand and home-price growth. With slower demand, the inventory of unsold existing homes increased to 950,000 as of the end of March. That would support 2.0 months at the monthly sales pace, which is still way below the 4-6 month supply available, historically.

So, we will depend on the construction of more rental units, apartments, to satisfy the continued demand for housing in years to come, just as we did in the 1970s for the growing population of baby boomers.

Harlan Green © 2021

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment