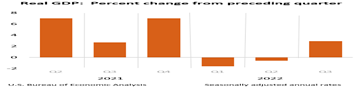

What is going on? The U.S. of Economic Analysis (BEA) just revised third quarter GDP growth higher, from 2.6 percent to 2.9 percent. And why? Mainly because consumers upped their spending in Q3, which increased 1.7 percent from the initial estimate of 1.4 percent.

I predicted consumers would want to celebrate the post-pandemic holidays, because COVID infection rates keep falling, despite the winter flu season, and the economy is still at full employment.

The trade gap also narrowed between exports and imports, meaning that exports increased more than imports, so more of the rest of the world is buying our products.

“The increase in real GDP reflected increases in exports, consumer spending, nonresidential fixed investment, state and local government spending, and federal government spending, that were partly offset by decreases in residential fixed investment and private inventory investment. Imports decreased,” said the BEA.

Exports increased in both goods and services, the BEA added. The rest of the world is wanting more of our industrial supplies and materials (notably nondurable goods), "other" exports of goods, and nonautomotive capital goods. Among services, the increase was led by travel and "other" business services (mainly financial services).

Top this with the Atlanta Fed’s GPNow prediction that Q4 GDP growth could be 4.3 percent. I said in my last column that the Atlanta Fed was right on with its Q3 prediction of 2.9 percent (which the BEA revised GDP upward from 2.6), which makes the Atlanta Fed’s Q4 prediction more credible.

“The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 4.3 percent on November 23, up from 4.2 percent on November 17,” said the Atlanta Federal Reserve, which tracks future growth trends. “After recent releases from the US Census Bureau and the National Association of Realtors, the nowcast of fourth-quarter real gross private domestic investment growth increased from 0.4 percent to 1.0 percent.”

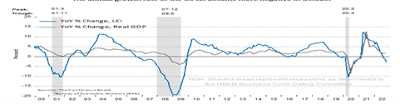

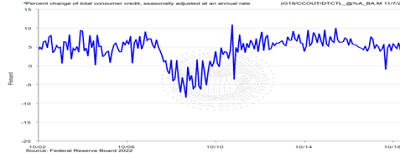

So the debate begins in earnest between inflation hawks and doves. Should our Federal Reserve keep clamping down on growth with more rate increases when consumers are willing to spend what it takes now, including borrowing heavily on their credit cards, to enjoy the holidays?

Won’t they eventually spend less in the New Year, anyway, as they rebuild their savings, which happened this year from January to June quarters? And does the Fed really want to clamp down on manufacturing during wartime when producing more will aid the Ukrainians and bring down prices?

Even wanting to return to a 2 percent inflation target makes little sense now, since their fear of “embedding” consumers’ expectations of higher inflation over the longer term hasn’t happened.

The Conference Board’s confidence survey shows consumers still believing that inflation over the next 5 years won’t rise above 3 percent, even if they remain more pessimistic over the near term.

The problem with inflation hawks is their insistence that they want to see an decrease in wage growth as part of the cure, when household incomes haven’t kept up with inflation since the 1970s. And research has shown that better paid workers produce more!

So targeting wage-earners because they may be earning too much as part of the inflation problem is counter-productive, in my opinion. It’s why the Fed should not boost short-term rates another 1 to 2 points.

And sure enough, Fed Chair Jerome at his latest press conference just announced that they will begin to “moderate” their rate increases. Why? There are 3.5 million workers still out of the workforce, mainly due to early retirement. So policies that increase labor participation should be encouraged, in Powell’s words. But workers will only be encouraged to return if their wages continue to increase more than inflation.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen