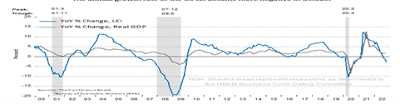

The recent 1,000 + point surge of the DOW following news of declining inflation in the latest CPI report may have been prompted by the Leuthold Group’s noted market analyst Jim Paulsen in a recent CNBC interview, when he said that “we may by heading for a new recovery rather than a recession.”

This is while the Conference Board’s Index of Leading Economic Indicators (LEI), a well-regarded prognosticator of future growth, is forecasting recession next year, as is Goldman Sachs and some economists.

The U.S. economy is in limbo at the moment, suspended and not sure of a direction. Half of it is running too hot (e.g., employment) and half too cold (e.g., housing), which means the U.S. economy could go either way in 2023—be in a recession or recovery.

“The US LEI fell for an eighth consecutive month, suggesting the economy is possibly in a recession,” said Ataman Ozyildirim, Senior Director, Economics, at The Conference Board. “The downturn in the LEI reflects consumers’ worsening outlook amid high inflation and rising interest rates, as well as declining prospects for housing construction and manufacturing. The Conference Board forecasts real GDP growth will be 1.8 percent year-over-year in 2022, and a recession is likely to start around yearend and last through mid-2023.”

That would make sense with the slowdown in manufacturing and the fact that housing busts have foretold recessions in the past. But it hasn’t stopped shoppers, which show up in service sector statistics. Retail sales that account for some half of consumer spending jumped a huge 1.3 percent in October, 7.6 percent YoY, with much of the boost due to leisure activities (e.g., dining out and travel).

And the Atlanta Federal Reserve’s GPNow estimate of future growth says fourth quarter growth could be as high as 4.2 percent! Its GPNow estimate proved to be almost right with its third quarter estimate of 2.9 percent (it was actually 2.6 percent) so its Q4 GDP prediction could also be in the ballpark.

Why the jump in GDP? Because the Atlanta Fed’s model shows consumer spending and exports still surging, while consumer expectations and personal incomes have remained high. So why wouldn’t consumers continue to spend in a fully-employed economy?

“The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 4.2 percent on November 17, down from 4.4 percent on November 16,” said the Atlanta Fed. “After this morning’s housing starts report from the US Census Bureau, the nowcast of fourth quarter real residential investment growth decreased from -7.6 percent to -11.7 percent.”

Manufacturing activity may be slowing but services are booming as reported in the latest retail sales report. Consumers are keeping up with inflation, in other words, and the holidays are an opportunity to celebrate their world returning to normal. Dining out at restaurants increased 1.3 percent in October, for instance, twice the current inflation rate.

Financial markets rallied again last Tuesday because the Producer Price Index (PPI) for wholesale goods and services continued its decline. Wholesale prices in October rose just 0.2 percent month-month and core inflation without food, energy and trade services declined from 5.6 to 5.4 percent YoY.

Some pundits have characterized this as a goldilocks economy that is neither too hot nor too cold. But half of our economy is still too hot (i.e., employment and consumer spending) and half too cold (manufacturing, housing), as I said.

So our economy is in limbo because of such uncertainty—poised between a recession or an economic recovery. But I believe not for much longer. Our economy is already on a wartime footing because of the $trillions needed to conquer the pandemic and modernize our economy. This should soon conquer the uncertainty and generate a lasting recovery.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment