“In considering the outlook for monetary policy, participants agreed that with economic growth and the labor market still solid and current monetary policy moderately restrictive, the committee was well positioned to wait for more clarity on the outlooks for inflation and economic activity.” FOMC

The Federal Reserve’s release of its minutes from the last FOMC meeting didn’t have much to say about the continuing tariff wars, because nothing has yet been negotiated—just some retaliatory pauses and a written understanding with the UK.

And it may take a while—could be months and years before actual trade agreements are agreed upon as they must pass congressional approval as well. The NAFTA North American Free Trade Agreement wasn’t agreed upon until 1992, though negotiations began in the late 1980s.

That puts the Fed in a very difficult position. We now know why President Trump has attempted to disguise the fact that it is an import tax. The Court of International Trade has ruled that Trump’s retaliatory tariffs are illegal.

The trade court ruled for a group of small businesses and Democratic-led states in finding that Trump tried to get around congressional approval by invoking a 1977 law that doesn’t mention tariffs.

It’s a separation of powers issue that will be fought in the courts, and may take some time, in other words.

Hence Chairman Powell’s concern that a recession may be on the horizon. “The staff viewed the possibility that the economy would enter a recession to be almost as likely as the baseline forecast.”

Why? Because higher taxes generally cause higher inflation, which trump denies will happen (it was a campaign promise), and Powell, et.al., have worked hard to get inflation down to its current level.

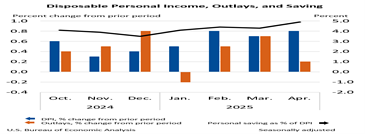

So it was good news that the just released Employment Cost Index rose just 2.1 percent in April; the core rate up 2.6 percent without auto and gas prices figured in. But the personal savings rate (black line in BEA graph) has been rising steadily, is up to 4.9 percent from its December low of 3.8 percent, which is a sign that consumers are becoming more cautious.

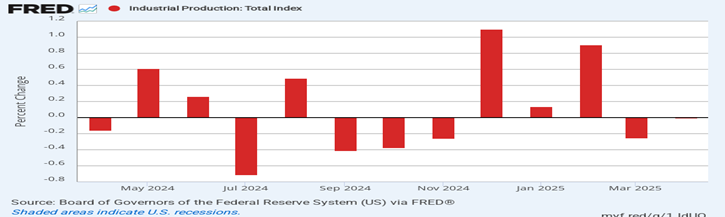

We already have a decline in two of the four major components that have determined past recessions: declining employment and flat industrial production because the tariff wars are slowing supply chains. The unemployment rate has risen from 3.6 percent in 2022 to 4.2 percent in April and long-term jobless compensation claims have been steadily rising.

The two other main indicators of a recession are consumer spending that has slowed to 1.2 percent from its usual 3-4 percent annual growth, and GDP growth that went negative -0.2 percent in Q1 for the first time since the COVID-19 pandemic.

So we could already be in a recession, and the tariff wars will certainly cause even more uncertainty.

The real problem is that Trump is trying to get around the legal process with what he asserts are emergency powers to stem the flow of fentanyl and lower the trade imbalances. Only Congress has the power to tax, not the Executive Branch, unless there’s a real emergency. Historical trade imbalances and fentanyl imports aren’t considered national emergencies that require making enemies of our closest allies.

Harlan Green © 2025

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen