“In April, U.S. manufacturing activity slipped marginally further into contraction after expanding only marginally in February. Demand and output weakened while input strengthened further, conditions that are not considered positive for economic growth.” ISM Manufacturing

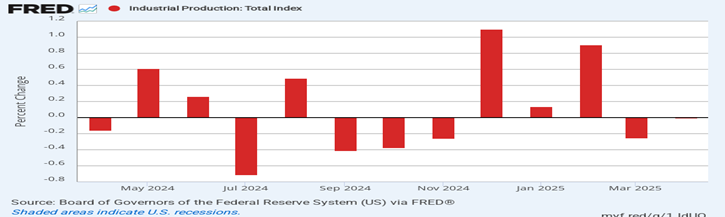

U.S. industrial production has stalled. Manufacturers are producing more than they can sell (higher input vs. output/demand). Unable to export the excess production, the Federal Reserve’s measure of industrial production showed seven months of zero or negative growth since last April.

What does that tell us? That manufacturing is no longer as important to our economy. We are now a mostly consumer-driven society that shops until we drop (and savings are exhausted), do lots of leisure things like travel and services that cater to us, such as healthcare, education, professional services (lawyers, doctors, engineers, etc.) construction, transportation and warehousing, and financial services.

But we also develop and export lots of software; information technologies, AI, ChatGPT and the like. This is all part of the service sector that really drives our economy. So, when President Trump says we need to bring back manufacturing, there’s not much manufacturing to bring back that would improve growth.

Also, we don’t have enough workers to fill the manufacturing jobs we have now. NyTimes’ David Brooks in an excellent Op-ed piece on our manufacturing history, said manufacturers can’t find enough workers today. There are almost 500,000 vacancies in manufacturing jobs. Trump is leading us down a blind path that only benefits him and Republicans, in other words.

This is while the service sector is still growing and will continue to grow even with more tariff threats if consumers will keep spending. The financial markets are more uncertain about future growth with higher tariffs because it means higher interest rates. We shouldn’t forget that former Fed Chair Alan Greenspan’s “irrational exuberance” speech warning that the financial markets were oversold, was four years before the Dot-com bubble burst and a recession ensued in 2000.

The Institute of Supply Management’s report on the service sector remains optimistic. “Economic activity in the services sector expanded for the 10th consecutive month in April, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®. The Services PMI® registered 51.6 percent, indicating expansion for the 56th time in 59 months since recovery from the coronavirus pandemic-induced recession began in June 2020.”

The take from this news is that Trump will make up any story to justify higher tariffs. He is thereby raising import taxes on the one hand for consumers and Main Street because we import so much, while cutting taxes for the wealthiest with the other hand via renewal of his tax cut bill that will cost more than $3trillion, according to government watchdog agencies.

Add the Medicaid and benefit cuts to the tariff costs, while firing those workers that run social security, Medicare; services that benefit all of us; and we can see the huge transfer of wealth to the oligarchs that Republicans’ budget deficits are engineering.

Harlan Green © 2025

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment