Financial FAQs

Believe it or not, when job creation is the issue, there is no conflict between the public (government) and private sectors of our economy. Yet it is a common misconception that governments take money and jobs away from the private sector.

The private sector only begins to hire more workers when it sees a sustained demand for its products and services, period. And that doesn’t happen during recessions. For instance, motor vehicles sales are surging—up over 13 percent annually in a steady growth pattern since last June. And because auto manufacturers have seen such sustainable growth, the manufacturing sector is hiring workers again.

But this wouldn’t have happened if government had stayed out of the picture. Both Chrysler and GM needed government help. Why? The private sector didn’t want to step up to restructure them. Corporations have been hoarding more then $2 trillion in cash from record profits over the past 2 years rather than investing in new facilities, while banks have been hoarding more than $1 trillion in excess reserves—reserves above and beyond what is required—instead of lending out to businesses wanting to expand. This is while the economy has lost more than 7 million jobs.

Overall demand had plunged due to the greatest recession since the Great Depression and the private sector had become risk averse—really risk averse; not wanting to take any chances at all, especially with the near-collapse of our financial system.

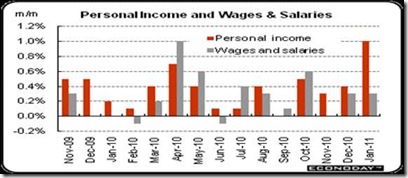

Why are we only now seeing an increase in hiring? Consumers feel confident enough to begin spending again. The consumer ended up with a fatter wallet in January, though it did not open it up as much as in recent months. Personal income in January surged 1.0 percent, following a 0.4 percent gain the month before.

As in December, consumer spending for the latest month was led by auto sales, as we said, and higher gasoline prices. Personal consumption expenditures increased a modest 0.2 percent, following a 0.5 percent advance in December. For January, strength was led by nondurables, up 0.9 percent (including gasoline), with durables advancing 0.4 percent.

And so employers are just beginning to hire again. Nonfarm payroll employment increased by 192,000 in February, and the unemployment rate fell to 8.9 percent from 9.0 percent, reported the U.S. Bureau of Labor Statistics last Friday.

December and January payrolls were also looking better. The change in total nonfarm payroll employment for December was revised from +121,000 to +152,000, and the change for January was revised from +36,000 to +63,000. The only real weakness was in government employment, which fell by 30,000. Local governments, many struggling with budget pressure, have cut 377,000 jobs since September 2008.

This means the private sector has only begun to venture from their foxholes. We really will not see a sustained recovery that feeds other sectors—such as housing—until the unemployment rate drops much lower, which Fed Chairman Bernanke predicts won’t happen for several years. The so-called private sector of small and large businesses has yet to make a substantial contribution to the ongoing recovery, in other words.

Harlan Green © 2011

No comments:

Post a Comment