Popular Economics Weekly

The jobs recovery continues, despite the doom and gloomers. This was highlighted in the JOLT Survey we put up last week. New job openings totaled 3.1 million this April, up from the low of 2 million in 2009 at the beginning of the recovery.

The hiring is in all sectors, with industrial production leading the way. But retail has picked up, and even construction is beginning to show some life. But first quarter Gross Domestic Product has slowed. The Commerce Department's second estimate for quarter GDP growth was unrevised at up 1.8 percent annualized and came in lower than the consensus forecast for 2.1 percent. The first quarter remains notably softer than the 3.1 percent growth in the fourth quarter.

Unfortunately, final sales of domestic product were revised to an annualized 0.6 percent from the initial estimate of 0.8 percent. Why care about it? The downward revision to final sales was mainly in personal spending, which is consumer expenditures and makes up 70 percent of GDP activity. It is now up 2.2 percent instead of the initial 2.7 percent for the first quarter.

The good news was that corporate profits in the first quarter expanded to $1.450 trillion annualized-up from $1.369 trillion in the fourth quarter, up an annualized 25.6 percent. Corporate profits are up 5.8 percent on a year-on-year basis, compared to up 11.4 percent in the fourth quarter. This means business has more room to expand and probably means a better looking second quarter for growth.

The current headwinds are due both to higher gas prices that have cut consumption and the Japanese Tsunami, that has cut auto production. So Industrial production has slowed, until the production of Japanese vehicles picks up again.

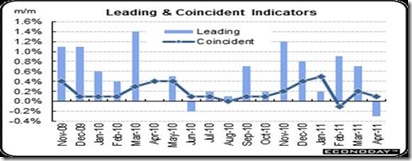

The Conference Board’s Index of Leading Economic Indicators shows a temporary slowdown. The weakest factor is initial jobless claims which sliced off 0.33 percentage points from the index's growth, but that could be temporary due to reduced auto production. Also negative are building permits and the factory workweek. But improved employment should make it positive next month.

More good news was that new homes are beginning to sell again. April sales of new homes added to March's gains, jumping 7.3 percent to a higher-than-expected annualized rate of 323,000. Strong sales drew down supply to 6.5 months from 7.2 in March and 7.9 in February. In a useful signpost for how deeply the residential sector has contracted, only 175,000 new homes are up for sale for the lowest total in data that goes back to 1963!

The improved jobs picture is boosting incomes. And income growth continued to support the consumer sector in April. Spending was moderately strong but largely due to higher prices. Notably, inflation is still on the warm side. As the report's biggest positive, personal income in April posted a 0.4 percent gain equaling the pace in March and matching analysts' forecast. Importantly, the key wages & salaries component increased 0.4 percent, following a boost of 0.3 percent in March.

Year on year, personal income growth for April posted at 4.4 percent, compared to 4.8 percent the prior month. PCEs growth rose a year-ago 4.8 percent, up from 4.4 percent the prior month. The good news is that income growth remains moderately strong. The bad news is that inflation has eaten into those earnings and has restrained real spending. The slowing in real spending may be transitory (a recently favorite word among Fed officials) but softer inflation and healthier income growth are needed, which will only come with businesses using some of their cash hoard to create more jobs.

Harlan Green © 2011

No comments:

Post a Comment