Popular Economics Weekly

Bloomberg Businessweek recently highlighted under the banner, “The Most Feared Man in Washington is…” a profile of Grover Norquist, the chief “Enforcer” of the no new taxes pledge taken by 233 of the 240 House Republicans crafted during House Speaker Newt Gingrich’s era of the Contract for America. The pledge binds all of its takers to oppose “any and all efforts” to increase marginal income tax rates and to protect tax deductions and credits, according to Businessweek.

But in fact this pledge has not succeeded in its stated goal of lowering government spending. In fact, it has mainly succeeded in starving the main engine of economic growth, consumers. For each time Republican administrations have cut taxes in the name of shrinking government, it has instead shifted wealth from the lower and middle income classes to the top income brackets, which lowers the overall demand for goods and services.

As former Reagan Budget Director David Stockman said in a April 25 New York Times Op-ed, “While not the stated objective of policy, this reverse Robin Hood outcome cannot be gainsaid: the share of wealth held by the top 1 percent of households has risen to 35 percent from 21 percent since 1979, while their share of income has more than doubled to around 20 percent.

Why hasn’t the no new taxes pledge succeeded? Because Republicans are no better at cutting government spending than Democrats—in fact worse. Republican administrations since Reagan have chosen to borrow to pay for their hot and cold wars, rather than sharing the sacrifice, driving us ever deeper into debt.

There are other reasons for slower growth, of course. A slower growing population with more seniors, saturated consumer markets (more than 2 cars in a garage?), are two of the reasons. But during the period 1951-63, when marginal rates were at their peak—91 to 93 percent—the American economy boomed, growing at an average annual rate of 3.71 percent. The fact that the marginal rates were what would today be viewed as essentially confiscatory, says New York Times’ pollster Charles Blow, did not cause economic cataclysm—just the opposite: “Whereas during the past seven years, during which we reduced the top marginal rate to 35 percent, average growth was a more meager 1.71 percent.”

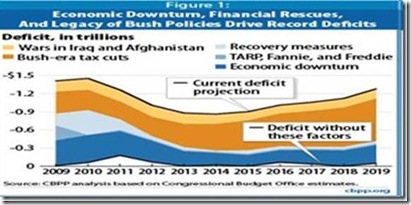

Which brings us back to the federal deficit, the reason we are debating methods to starve the beast of government spending in the first place. It was caused first and foremost by the Bush-era tax cuts to the highest marginal tax rates, and on dividends and capital gains earned by the investor class. This in addition to the 2 wars has cost us more than $3 trillion in borrowed money to date, and the reason our deficit is still growing.

Grover Norquist, a Harvard MBA business degree graduate, has chosen to do his economic jousting without even the most basic knowledge of economics, it seems. Economic demand theory teaches that taking money from the pockets of those who spend most of it and transferring it to those who save most of it doesn’t increase demand for products.

Economic historians in particular know that tax cuts without sending cuts do not lower deficits, period, since it chokes off the revenues needed to pay down the deficit. The two largest expansions of debts as a percentage of GDP were during the Reagan and Bush Presidencies—from a low of 47 percent in the 1970s to its current some 80 percent. They were also the administrations that did the most tax cutting, without comparable spending cuts.

Nor do tax cuts—particularly to the highest marginal tax rates—stimulate more growth. In fact, we have seen a historical drop in GDP growth since the decline in highest marginal rates (of 93 percent) that prevailed during the Eisenhower administrations. The only time we have seen a real decline in the federal budget deficit was during the Clinton Presidency, when Clinton and Congress agreed to maintain Pay as You Go budget rules that said spending had to match revenues. The highest marginal tax rate was raised to 39 percent while government spending as a percentage of GDP fell during the Clinton era, so that the annual deficit was actually erased from 1997 to 2001.

Alas, President Reagan wanted to outspend the Russian military, while the GW Bush wanted to invade Iraq without spreading the pain. Instead, he made the call after 9/11 for everyone to go shopping. The problem was that shifting so much wealth to the wealthiest shortchanged consumers, who had to borrow beyond their means to take his advice.

When will we learn the lessons of history? Grover Norquist may be “the most feared man in Washington…” only because we are doomed to repeat our historic mistakes, if we do not now understand how and why the federal deficit was created.

Harlan Green © 2011

13 comments:

Thanks for sharing your thoughts about construction

toy. Regards

My weblog :: smog check in national city

Hello to all, the contents existing at this site are truly remarkable for people experience,

well, keep up the nice work fellows.

Here is my blog post - plumbing leaks in novi

Excellent weblog here! Additionally your web site rather a lot up fast!

What web host are you using? Can I get your associate hyperlink on

your host? I want my web site loaded up as quickly as yours lol

my website; notary agent in norco

Thank you for every other magnificent post. The place else may anyone get that kind

of information in such a perfect method of writing? I have a presentation subsequent week, and I am on the look for

such info.

Look at my web-site ... doors in brea

Hi there would you mind sharing which blog platform you're working with? I'm going

to start my own blog in the near future but I'm having a hard time choosing between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design and style seems different then most blogs and I'm looking for something

unique. P.S My apologies for getting off-topic but I had to ask!

Feel free to visit my site ... tile repair in pacific beach

my page :: residential roofing contractor in pacific beach

I don't know if it's just me or if perhaps everyone else encountering issues with

your blog. It appears like some of the written text in your content are running off the screen.

Can someone else please comment and let me know

if this is happening to them too? This might be a problem with my browser because I've had this happen previously. Appreciate it

Check out my web site: home remodeling in west des moines

my web page :: remodeling in altoona

Whoa! This blog looks exactly like my old one!

It's on a completely different topic but it has pretty much the same layout and design. Excellent choice of colors!

my blog - residential plumbing in murrieta

Very nice post. I just stumbled upon your blog

and wanted to say that I've truly enjoyed surfing around your blog posts. After all I will be subscribing to your feed and I hope you write again very soon!

My web blog; homepage

you're in reality a excellent webmaster. The site loading speed is amazing. It seems that you are doing any unique trick. In addition, The contents are masterpiece. you've performed a magnificent process in this topic!

Feel free to surf to my website; debt settlement in mission valley

Appreciation to my father who stated to me concerning this website, this website is actually awesome.

My webpage - carpeting in philadelphia

My web site :: wood floors in wayne

You actually make it seem so easy together with your presentation however I to find this topic to be actually one thing that I think I would never

understand. It seems too complicated and extremely broad for me.

I am looking forward for your next submit, I'll try to get the hang of it!

Feel free to surf to my blog :: kitchen remodeling in puyallup

Your way of telling all in this paragraph

is truly fastidious, all be capable of effortlessly understand it, Thanks a lot.

Here is my page; loan signing agent in corona

z8v58r6u21 s2q94p2f89 h2v25l8s10 a9p08q2d87 d9t03g9l12 h8q11s7o89

Post a Comment