The Mortgage Corner

Renters and young couples are shooting themselves in the foot if they continue to find ways to postpone buying a home. Housing affordability continues to new highs, as mortgage rates slip to a new post-WWII low, and housing prices recede back to 2000 levels. On top of that, mortgage delinquency rates are declining, which signals that inventories are declining as well.

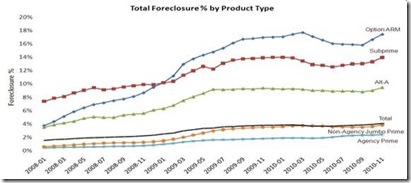

Fannie Mae reported that the serious delinquency rate decreased to 4.27 percent in March, close to the long term historical average. This is down from 5.47 percent in March 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59 percent. Freddie Mac reported that the serious delinquency rate decreased to 3.57 percent in April. (Note: Fannie reports a month behind Freddie). This is down from 4.06 percent in March 2010 and Freddie's serious delinquency rate also peaked in February 2010 at 4.20 percent.

The most recent National Association of Home Builders/Wells Fargo Housing Opportunity Index (HOI) indicated that 74.6 percent of all new and existing homes sold in the first quarter of 2011 were affordable to families earning the national median income of $64,400. This eclipsed the previous high of 73.9 percent set during the fourth quarter of 2010 and marked the ninth consecutive quarter that the index has been above 70 percent. Until 2009, the HOI rarely topped 65 percent and never reached 70 percent.

Federal Reserve policies are mainly responsible for keeping mortgage rates so low, as well as investors looking for higher yields than given by Treasury Bonds. Mortgage rates are now at post-WWII historic lows. Conforming 30-yr fixed mortgages are priced at 4.375 percent with 0 points origination fee, for example. The so-called high-balance conforming limit to $729,750 is now 4.625 percent with 0 points, and even the 30-yr super jumbos to $3m are now at 5 percent, 0 points, signaling that ‘Private Label’ mortgages (i.e., not insured or guaranteed by government agencies) are again available to homeowners, albeit with AAA credit scores.

Housing prices seem to be most closely tied to employment. Calculated Risk shows that housing prices have peaked historically in three of the past four recessions at the same time that the employment rate peaked in the 4-5 percent range. Conversely, housing prices bottomed when unemployment began to fall from its high in each of those recessions. So we expect that to happen this year, as employment continues to improve.

The S&P Case-Shiller Home Price Index isn’t showing this improvement, mainly because it is a 3-month moving average through March, and employment has been expanding more robustly since then. The March figures showed just Washington D.C. and Seattle prices up of its 20 cities’ index. Also the home selling season is just beginning, with new home sales beginning to pick up—albeit from historic lows, as we said last week.

The economy’s growth rate has moderated as it has moved from recovery to expansion. From a technical perspective, the recovery turned to expansion when output surpassed the previous peak which actually occurred in the third quarter of 2010 based on GDP. Though housing is still in the doldrums, household formation should treble and top 1 million this year, as we said last week, as rising rents make it more affordable to buy. The consumer sector continues to advance and we believe will strengthen along with job gains—especially if oil prices have peaked. It is really only consumers who will make this a sustainable recovery.

Harlan Green © 2011

1 comment:

Hi, Harlan Russell Green, It's very informative blog post. thanks for sharing.Shnoop.com - Deal of the day! Daily deal Everyday! 1-Day Sale! Shnoop.com

Post a Comment