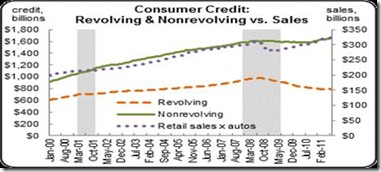

Consumers continue to spend, in spite of the doom and gloom of the latest confidence surveys and high unemployment rate. This is confirmed in part with July’s outstanding consumer credit numbers, as well as a robust service sector. Overall consumer credit advanced $12.0 billion in July, following an $11.3 billion boost the prior month. But the latest increase was due to a solid gain for auto sales in July as nonrevolving credit rose $15.4 billion. Nonrevolving credit has now risen for 11 straight months.

In contrast, gains in revolving credit, reflecting credit-card use, have been hard to come by with the component down $3.4 billion in July to end a short run of strength. Consumers continue to deleverage credit card balances and banks are still writing off bad credit card debt though at a slower pace.

The good news is that consumers are still spending—but increasingly with cash, says Econoday. Retail sales excluding autos hit a recent bottom of $278.9 billion in March 2009 and for July 2011 posts at $323.6 billion—a cumulative 16.0 percent rebound. Keeping the plastic in wallets has slowed retail sales growth but it likely has been necessary to strengthen consumer balance sheets that had become way out of balance with debt. Until job growth picks up, consumers will likely be reluctant to take on more debt and sales growth will remain moderate. And importantly, sales growth is possible even without the plastic.

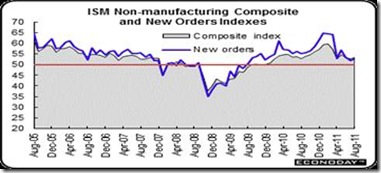

And service sector growth, which now makes up two-thirds of economic activity, is also holding in the ISM non-manufacturing report. The Institute For Supply Management’s non-manufacturing composite actually edged 0.6 points higher to 53.3, when anything above 50 means expansion. This was a sharp contrast with a number of regional surveys that had turned negative. It also topped market expectations for a reading of 51.1.

The debt-ceiling drama and the S&P downgrade of the US did in fact pull down consumer confidence which fell in August to 44.5 for the lowest reading since April 2009. Weakness was concentrated heavily in the leading component which is expectations where the consumer's outlook on employment, business conditions and on income all fell. The expectations index, at 51.9, is also at its lowest level since April 2009.

This hasn’t stopped consumer spending, as I said, which rebounded a sharp 0.8 percent after slipping 0.1 percent in June. By components, durables jumped 1.9 percent after declining 1.1 percent in June. Clearly, motor vehicle sales are up as the supply constraint related parts shortages from Japan is easing. Nondurables increased 0.7 percent, following a 0.5 percent decrease in June. Services rose 0.7 percent after nudging up 0.1 percent in June. The latest numbers on spending should allay concern about a double-dip recession—even with the latest jobs report.

This should put double-dip fears to rest. The current fears have more to do with Europe’s problems. And if President Obama fights for his new $447-billion jobs plan, then the fears will be confined to Europe, which still believes that austerity is the way to prosperity. But given the latest zero job growth numbers and public discontent with the current ‘do nothing’ Congress, US politicians might finally be convinced that creating more jobs is the path to prosperity.

Harlan Green © 2011

No comments:

Post a Comment