Popular Economics Weekly

It’s officially the end of summer, start of school, fall colors, and Obama’s upcoming September 8 joint congressional State of the Jobs Market. With the labor market in dire straits, what can we say about this year’s Labor Day Holiday?

Former French Finance Minister and new IMF Managing Director Christine Lagarde gave a highly regarded speech at the Fed’s Jackson Hole conference that said in effect this was the wrong time to implement more austere, budget cutting policies with labor in such trouble. “In the United States, policymakers must strike the right balance between reducing public debt and sustaining the recovery—especially by making a serious dent in long-term unemployment,” she said.

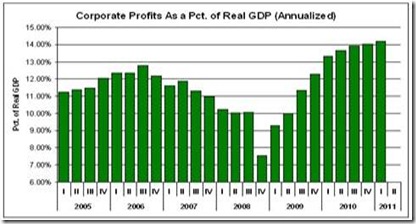

But the latest data on record corporate profits tells us something alarming. Because of the globalization of technology, businesses know how to expand without hiring more employees—at least in this country. About 83 percent of S&P 500 companies have beat second quarter 2011 analyst estimates according to data compiled by Bloomberg News. This is while S&P recently reported that in 2010, 46.3 percent of all S&P 500 company sales originated outside of the US.

“If we look at the last 10 years, the divergence between the corporate profits of S&P 500 companies and domestic GDP growth is astonishing,” said GC Mays, an Independent / boutique research firm analyst in his Seeking Alpha blog. “Between the first Quarter of 2001 and 2006, a simple correlation showed that corporate profits explained 98.4 percent of domestic GDP growth. However, the most recent five years beginning with the first quarter of 2006 the correlation between corporate profits and domestic GDP growth breaks down as corporate profits only explain 10.1 percent of domestic GDP growth.”

Graph: The Mays Report

Why is it necessary to increase jobs when we now know we can have economic growth without job growth? Well, beside the obvious voter anger if politicos don’t take the lead in creating more jobs, it means taking away the demand that can grow the domestic economy. Corporate profits have risen to the highest level as a percentage of Gross Domestic Product since the Great Depression—14 percent—but much of the profit comes from overseas’ sales of U.S. companies, as we said.

And that doesn’t augur well either for decreasing the record income inequality for most wage earners or growing domestic jobs. Since World War II the unemployment rate has twice reached 10 percent—during the 1981-82 and just ended 2007-09 recession. But because of the housing and financial crashes that accompanied the Great Recession—or Small Depression, as Krugman has christened it—consumers are not spending and employers not hiring domestically as they have in past recoveries.

That means corporate profits are no longer dependent on domestic demand, so are not going to help reduce the various deficits—both household and governmental—without explicit policies to create more domestic jobs. It’s a straightforward equation. Decreasing domestic unemployment means decreasing domestic deficits, and growing household incomes means growing domestic businesses. But since corporations are no longer dependent on growing domestic jobs to sell their products, what policies will? Director Lagarde says it best:

“First—the nexus of fiscal (budget) consolidation and growth. At first blush, these challenges seem contradictory. But they are actually mutually reinforcing. Credible decisions on future consolidation—involving both revenue and expenditure—create space for policies that support growth and jobs today. At the same time, growth is necessary for fiscal credibility—after all, who will believe that commitments to cut spending can survive a lengthy stagnation with prolonged high unemployment and social dissatisfaction?”

We can hope that Labor Day will be a cause for celebration; an international coming together of Big Business and dueling politicians on the need for concrete job creation policies. Make no mistake that as the public becomes better informed on the causes of the current employment malaise, they will seek out leaders who can implement the reforms necessary to correct the imbalance between growing corporate profits and declining payrolls.

“In sum,” concludes Lagarde, “risks to the global economy are rising, but there remains a path to recovery. The policy options are narrower than before but there is a way through. There are lingering uncertainties, but resolute action will help to dispel doubts.”

Harlan Green © 2011

No comments:

Post a Comment