Financial FAQs

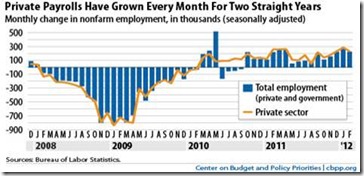

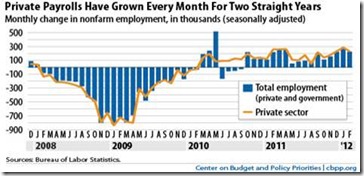

The pundits and some economists just don’t seem to get it. Friday’s unemployment report was gangbusters. The gains were not just ‘ok’, per Marketwatch, or are at a ‘speed-walk’, per Barron’s Gene Epstein. Gains are in fact accelerating with private payrolls’ 3-month average now 251,000, and unemployment rate steady at 8.3 percent, even with 428,000 re-entering the workforce in February that had stopped looking for work.

One reason for the muted optimism is that last year payrolls actually increased 261,000 through April of last year, and then plunged. This was of course due to the Japanese Tsumani, political gridlock over the budget deficit that caused an S&P credit downgrade of U.S. debt, and euro worries. But even then, job growth was better than the data, which originally showed no jobs growth in August, for instance, that turned into 103,000 nonfarm payroll jobs when revised, and an additional 50,000 jobs in September.

It was the initial jobs estimates that caused recession talk at that time, and consumer and business confidence to plunge. The same underestimation could be happening this year, also, as December and January payrolls were revised upward by 61,000. On top of that, the Labor Department’s so-called ‘payroll-compatible’ Household Survey, which subtracts agricultural and self-employed workers from the separate Household Survey, showed 879,000 jobs created in February, and a 263,000 average over the past 12 months, vs. a 168,000 per month average from the nonfarm payrolls survey. The real average is probably somewhere between the two surveys done by the Bureau of Labor Statistics.

We also know from consumer borrowing data that consumers are spending as if they believe the jobs picture will continue to improve, based on a major five-month surge in outstanding credit, the latest a $17.8 billion gain in January versus a revised $16.3 billion gain in December. During the five months, outstanding credit has jumped $68.5 billion. At $2.512 trillion, total outstanding credit is only $70 billion below its July 2008 peak of $2.582 trillion.

Harlan Green © 2012

The pundits and some economists just don’t seem to get it. Friday’s unemployment report was gangbusters. The gains were not just ‘ok’, per Marketwatch, or are at a ‘speed-walk’, per Barron’s Gene Epstein. Gains are in fact accelerating with private payrolls’ 3-month average now 251,000, and unemployment rate steady at 8.3 percent, even with 428,000 re-entering the workforce in February that had stopped looking for work.

Graph: CBPP

This is the 24th straight month of private-sector job creation, with payrolls growing by 3.9 million jobs (a pace of 164,000 jobs a month) since February 2010, reports the Center on Budget and Policy Priorities. Total nonfarm employment (private plus government jobs) has grown by 3.5 million jobs over the same period, or 144,000 a month. The loss of 485,000 government jobs over this period was dominated by a loss of 347,000 local government jobs. One reason for the muted optimism is that last year payrolls actually increased 261,000 through April of last year, and then plunged. This was of course due to the Japanese Tsumani, political gridlock over the budget deficit that caused an S&P credit downgrade of U.S. debt, and euro worries. But even then, job growth was better than the data, which originally showed no jobs growth in August, for instance, that turned into 103,000 nonfarm payroll jobs when revised, and an additional 50,000 jobs in September.

It was the initial jobs estimates that caused recession talk at that time, and consumer and business confidence to plunge. The same underestimation could be happening this year, also, as December and January payrolls were revised upward by 61,000. On top of that, the Labor Department’s so-called ‘payroll-compatible’ Household Survey, which subtracts agricultural and self-employed workers from the separate Household Survey, showed 879,000 jobs created in February, and a 263,000 average over the past 12 months, vs. a 168,000 per month average from the nonfarm payrolls survey. The real average is probably somewhere between the two surveys done by the Bureau of Labor Statistics.

We also know from consumer borrowing data that consumers are spending as if they believe the jobs picture will continue to improve, based on a major five-month surge in outstanding credit, the latest a $17.8 billion gain in January versus a revised $16.3 billion gain in December. During the five months, outstanding credit has jumped $68.5 billion. At $2.512 trillion, total outstanding credit is only $70 billion below its July 2008 peak of $2.582 trillion.

Graph: Econoday

Are there any flies in the ointment of continued strong U.S. growth, besides worries over the euro and Middle East stability? The primary one is the federal budget deficit, and there is but one way to fix it—by restoring the Clinton-era tax rates that created 4 consecutive years of budget surpluses. It would correct the mistakes of the Bush Administration that chose to waste those surpluses on two wars and tax breaks for those who didn’t need it. This resulted in soaring corporate profits, whose executives chose to invest in excessive salaries and risky market speculation, rather than boosting the jobs and incomes of ordinary citizens.

Graph: CBPP

The Center for Budget Policies and Priorities said it best:- The average income of the top 1 percent of households rose by nearly 12 percent from 2009 to 2010, after adjusting for inflation. The average income growth for the richest households at the very top of the income distribution was even stronger.

- The average income of the bottom 90 percent of households, in contrast, which fell substantially during the recession in both 2008 and 2009, remained at its lowest level since 1983, in inflation-adjusted dollars.

Harlan Green © 2012

1 comment:

Choosing for the best and trusted mortgages broker is always important for the security og your financial needs.

Post a Comment