The Mortgage Corner

Dr. Robert Shiller, Yale Econ Professor, and co-creator of the Case-Shiller Home Price Index, has become very cautious in his latest articles. Don’t expect much in the way of a housing boom in 2013. He isn’t even sure even prices will continue to rise as they have over the past 3 years given all the headwinds, such as tighter mortgage regulations, a declining percentage of homeowners versus renters, and low consumer expectations in general.

This is in spite of the fact that home sales are up some 5 percent, and his own price index is 5.5 percent higher in one year, for the strongest year-over-year growth since August 2006 with increases in 19 of 20 cities..

“On the one hand, there were sharp price increases in 2012, with the S.&P./Case-Shiller 20-City Index, said Dr. Shiller, “which I helped devise, up a total of 9 percent over the six months from March to September. That comes after what was generally a decline in prices for five consecutive years. And while prices dropped very slightly in October, the trend was quite encouraging for the market.”

“But some of these changes were seasonal,” he continues. “Home prices have tended to rise every midyear and to fall slightly every fall and winter. And for some unknown reason, seasonal effects have become more pronounced since the financial crisis.”

Yet he cites a consensus of some 100 economists that real prices will rise 1 to 2 percent over inflation in coming years. Folks, that is the historical norm for housing prices in the 20th century that Dr. Shiller himself cites in his second edition of Irrational Exuberance.

Why so much pessimism from the Oracle who actually coined the term ‘irrational exuberance’ that Fed Chairman Greenspan used in his famous speech so many years ago?

Graph: Calculated Risk

I believe he is neglecting what is behind the current surge in home buying—pent up demand, and record low interest rates that the Fed has vowed to keep low until the unemployment rate falls to the 6 percent range from the current 7.8 percent. Pent up demand is a powerful driver of home building, for one thing. And household formation is predicted to double to some 1.3 million per year in coming years from a low as 350,000 annually during the Great Recession.

That, and real interest rates make homes the most affordable in history, according to the National Association of Realtors. While this won’t bring us back to boom times, it will at least restore housing to its proper place in the economy.

Even though national existing-home sales declined 1.0 percent to a seasonally adjusted annual rate of 4.94 million in December from a downwardly revised 4.99 million in November, sales are 12.8 percent above the 4.38 million-unit level in December 2011, says the National Association of Realtors.

Graph: Calculated Risk

The result is total housing inventory at the end of December fell 8.5 percent to 1.82 million existing homes available for sale, which represents a 4.4-month supply at the current sales pace, down from 4.8 months in November, and is the lowest housing supply since May of 2005.

This means new-home construction will have to pick up to satisfy the increasing demand for housing, as we have said in past weeks. And the outlook is good, with privately-owned housing starts in December at a seasonally adjusted annual rate of 954,000. This is 12.1 percent above the revised November estimate of 851,000 and is 36.9 percent above the December 2011 rate of 697,000, according to the US Census Bureau.

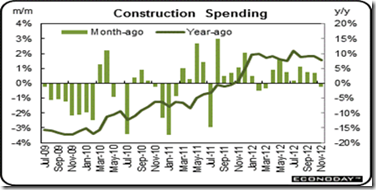

Graph: Econoday

On a year-over-year basis, private residential construction spending is now up 19 percent. Non-residential spending is up 8 percent year-over-year mostly due to energy spending says Calculated Risk. Public spending is down 3 percent year-over-year, and that is the real problem. Governments should be spending much more on public infrastructure, when and if the economy returns to more normal growth.

Hence we do not share Dr. Shiller’s uncertainty about the direction of home prices. Extremely tight housing inventories mean demand has picked up substantially. It all might depend on one’s definition of a housing ‘boom’. No one expects a return to the bubble years when consumers borrowed more than they earned. Maybe it’s a relief just to return to a more normal housing market?

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen

No comments:

Post a Comment