Popular Economics Weekly

What will bring US back to full employment is a very big question among economists. The problem is that the 155,000 per month nonfarm payroll average in 2012 isn’t enough to either absorb new entrants, or those that have lost jobs during the Great Recession.

Most macro economists know this. Only investment of more money grows a sluggish economy. And that requires more than the Fed’s printing of money (which at least keeps interest rates low), but isn’t in itself a direct catalyst for investment programs. It requires Congress and more expansionary fiscal policies to create jobs programs that will directly improve economic well-being. Until that happens, this will be a limpid recovery.

We know government spending tied to specific programs works because the $787 billion ARRA stimulus package of 2009 created or preserved as many as 3 million jobs. Had it been continued, say economists such as former Obama Chief Economic Advisor Christina Romer, we would have a much lower unemployment rate today.

December nonfarm payroll employment rose by 155,000, and the unemployment rate was unchanged at 7.8 percent, the U.S. Bureau of Labor Statistics reported Friday. The change in total nonfarm payroll employment for October was revised from +138,000 to +137,000, and the change for November was revised upward from +146,000 to +161,000.

Graph: Calculated Risk

The crux of our problem? The Labor Force Participation Rate was unchanged at 63.6 percent in December. This is the percentage of the working age population in the labor force. The participation rate is well below the 66 percent to 67 percent rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics, according to the Labor Department, as birth rates decline and the labor force ages, reducing the labor supply.

So how to put more Americans back to work? Keynesian and Neo-Keynesian macro economists, such as Paul Krugman, know the answer. He has said, for instance, “If the American Jobs Act, proposed by the Obama administration last year, had been passed, the unemployment rate would probably be below 7 percent.”

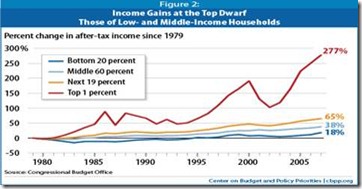

Create programs that put money back into the pockets of those consumers who spend it—mainly the 80 percent who earn wages and salaries. They are the drivers of aggregate demand, the amount of money actually in circulation that produces ‘things’. Most of the income gains since 2000 have shifted to the top 10 percent who spend considerably less as a percentage of incomes. Or, it has remained in corporate coffers with their record profits, rather than reinvested domestically—precisely because of the slack demand.

Graph: CBPP

So we are back to the chicken and egg argument. Which comes first? We know the historical answer. Chickens aren’t laying more eggs because consumers are eating less eggs. And that’s because they can’t afford to buy more eggs. So farmers cut back on egg production.

Meanwhile, the public sector has been badly neglected—repair of roads, bridges, schools, the research and development of new technologies, to name a few. There are jobs waiting to be filled that only public revenues can finance, in other words. So there is no reason to allow the further deterioration of the ‘things’ that benefit all Americans, regardless of income level.

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen

1 comment:

simply stopping by to say hello

Post a Comment