The Mortgage Corner

The July S&P Case-Shiller home price index shows home prices are in full recovery mode. Over the last 12 months, prices rose 12.3 percent and 12.4 percent as measured by the 10- and 20-City Composites in the major cities and metro areas, which are a 3-month average of same-home increases. And because the Fed still in full credit easing mode with its September decision to maintain QE3 securities’ purchases at $85 billion per month, interest rates are beginning to decline

Data through July 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices showed increases of 1.9 percent and 1.8 percent from June for the 10- and 20-City Composites. For at least four months in a row, all 20 cities showed monthly gains. Phoenix posted 22 consecutive months of positive returns. Although home prices in all the cities increased, 15 cities and both Composites those increases slowed in July versus June.

“Home prices gains are holding their 12 percent annual rate of gain established by the two Composite indices in April,” says Chairman David M. Blitzer, of the S&P Dow Jones Indices. “The Southwest continues to lead the housing recovery. Las Vegas home prices are up 27.5 percent year-over-year; in California, San Francisco, Los Angeles and San Diego are up 24.8, 20.8 and 20.4 percent, respectively. However, all remain far below their peak levels.”

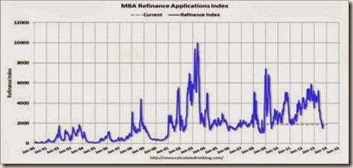

The result of lower mortgage rates is mortgage applications are also increasing, after falling sharply in May when the Fed first hinted it would begin to tighten credit in the fall. Mortgage applications increased 5.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 20, 2013.

The Refinance Index increased 5 percent from the previous week. The seasonally adjusted Purchase Index increased 7 percent from one week earlier. The Purchase Index was at its highest level since July 2013.

The HARP share of refinance applications increased to 41 percent from 40 percent the week before, and is the highest since MBA started tracking this measure in early 2012. So there is the feeling that many home owners with negative home equity are only now taking advantage of refinancing their underwater mortgages at current interest rates. The HARP program allows mortgage holders to refinance when debt can be as much as 150 percent of their home’s value.

So the Federal Housing Finance Authority has stepped up its campaign to encourage more homebuyers to apply for HARP refinancing. Acting FHFA Director Edward J. DeMarco said that 2.8 million homeowners have refinanced through HARP but with mortgage rates still historically low and HARP eligibility requirements expanded, other qualified homeowners could reduce their monthly mortgage payments or build their equity faster with a shorter term mortgage through the program.

DeMarco told Bloomberg News in an interview this weekend that FHFA used focus groups to find out why borrowers with high rates hadn't yet tried to refinance through HARP. They found many didn't realize they were eligible. They thought they had to be delinquent on their mortgages before the government would help them. DeMarco said he hoped the educational outreach would bring in an additional 2 million HARP borrowers.

This is while total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose to a seasonally adjusted annual rate of 5.48 million in August from 5.39 million in July, and are 13.2 percent higher than the 4.84 million-unit level in August 2012, reported the National Association of Realtors.

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen

No comments:

Post a Comment