The Mortgage Corner

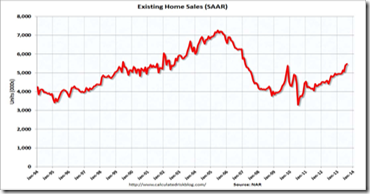

Existing-home sales have finally taken off, a sign that real estate might now be leading the economic recovery. Real estate has historically led past recoveries, by employing so many construction workers and professional services, but not this one to date due to the busted housing bubble.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 1.7 percent to a seasonally adjusted annual rate of 5.48 million in August from 5.39 million in July, and are 13.2 percent higher than the 4.84 million-unit level in August 2012, reports the National Association of Realtors.

And total housing inventory at the end of August increased 0.4 percent to 2.25 million existing homes available for sale, which represents a 4.9-month supply at the current sales pace, down from a 5.0-month supply in July. So the very low inventory is causing housing prices to soar, which will ultimately cure much of the negative home equity still existing. Unsold inventory is 6.3 percent below a year ago, when there was a 6.0-month supply.

Lawrence Yun, NAR chief economist, said the market may be experiencing a temporary peak. “Rising mortgage interest rates pushed more buyers to close deals, but monthly sales are likely to be uneven in the months ahead from several market frictions,” he said. “Tight inventory is limiting choices in many areas, higher mortgage interest rates mean affordability isn’t as favorable as it was, and restrictive mortgage lending standards are keeping some otherwise qualified buyers from completing a purchase.”

But that may not be so with the Federal Reserve’s decision to put off tapering QE3 purchases. Conforming 30-year fixed mortgage interest rates plunged one-quarter percent on Wednesday to 4.25 percent for zero points origination fee in California, when the Fed announced its decision to continue the $85 billion in purchases.

The national median existing-home price for all housing types was $212,100 in August, up 14.7 percent from August 2012. This is the strongest year-over-year price gain since October 2005 when the median rose 16.6 percent, and marks 18 consecutive months of year-over-year price increases, said the NAR.

Even more importantly, distressed homes – foreclosures and short sales – accounted for 12 percent of August sales, down from 15 percent in July, and is the lowest share since monthly tracking began in October 2008. They were 23 percent in August 2012. Ongoing declines in the share of distressed sales are responsible for some of the growth in median price.

Granted much of the boost in home sales and rising interest rates comes from the fear that QE3 would end. But with interest rates again falling, both home purchases and mortgage refinancing will be boosted. So it looks like the Fed is maintaining it commitment to reviving the housing market, as well as economic growth in general.

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen

No comments:

Post a Comment