Popular Economics Weekly

Once upon a time, the U.S. was considered to have a “Goldilocks” economy that was neither too hot nor too cold; where inflation was moderate, yet there was full employment. This last happened in the late 1990s when the unemployment rate shrank as low as 4 percent in 2000 and inflation remained in the 3-4 percent range. In fact, some 22 million jobs were created from 1992 to 2000 during the Clinton administration which also resulted in 4 years of federal budget surpluses

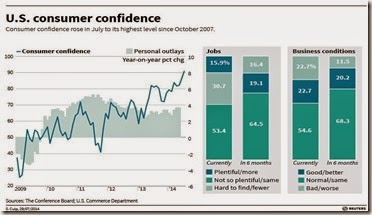

We might be coming into a similar period today, with consumer confidence beginning to soar because of better income, job prospects, and core inflation still below 2 percent. This is while the first estimate of Q2 GDP growth just in reports growth soaring. But it may be the U.S. economy playing catchup from the horrid first quarter’s severe winter when much of the country was in deep freeze.

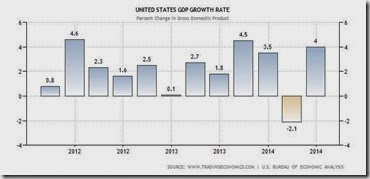

The Gross Domestic Product (GDP) in the United States expanded by a seasonally adjusted annual rate of 4 percent in the second quarter of 2014 over the previous quarter. GDP Growth Rate in the United States averaged 3.27 Percent from 1947 until 2014, reaching an all-time high of 16.90 Percent in the first quarter of 1950 and a record low of -10 Percent in the first quarter of 1958, says Trading Economics. So 4 percent looks like a normal growth rate for this stage of the recovery.

But such a Goldilocks recovery may depend on Janet Yellen’s Fed Governors’ attitude towards inflation expectations. In fact, full employment has never been achieved unless inflation rates were in the 3-5 percent range, which means bucking Wall Street, which doesn’t like inflation. Creditors never do, since it devalues their debt, but fuller employment means tolerating some inflation, which also means higher profits and so more jobs.

Consumer confidence is by far at its best level of the recovery, at a much higher-than-expected 90.9 in July vs an already very strong and upwardly revised 86.4 in June. July's level is the highest since December 2007 while the June reading is the second highest since January 2008.

July's gain is led by the expectations component which is up a very sharp 6.3 points to 92.7 for the highest reading since February 2011, with future job prospects and income expectations higher. The present situation component is up 2.0 points to 88.3 for the highest reading since March 2008.

Friday’s unemployment report will probably also confirm that we are entering the best of job environments, with the unemployment rate possibly below 6 percent for the first time since 2006.

Today’s release of the last FOMC meeting minutes shows the Fed is on the right track in maintaining low interest rates. Though growth is increasing and there are hints of higher inflationary tendencies, there is still “significant underutilization of labor resources,” said the Governors. “The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.”

The question is how long will the Fed allow some inflation before putting on the credit brakes by raising interest rates? They have said they might wait until summer 2015 before initiating any raises. If done prematurely, it will shorten this recovery, as has happened in past recoveries.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment