The Mortgage Corner

Fixed 30-year conforming interest rates have once again dropped slightly below 4 percent for a 1 pt. origination fee in California, after being as high as 4.50 percent earlier this year. Why the drop when most economic indicators show the economy recovering from the harsh winter? The unemployment rate has dropped to 6.1 percent. And both the service and manufacturing sector Institute for Supply Management indicators show strong growth.

The easy answer is the lack of inflation, which is still below 2 percent overall. Interest rates follow inflation trends in general, since inflation cheapens the value of bonds. But less obvious is the fact that 2014 housing sales have slowed, putting less pressure on mortgage rates even though home prices continue to rise.

It’s easy to see from the graph that 2013 mortgage rates (blue line) rose after June, as housing sales rose, and began to decline in 2014 (red line) due in part to the winter deep freeze and geopolitical unrest. Paradoxically, even with the decline in the Fed’s QE3 bond purchases, rates have continued to decline this year.

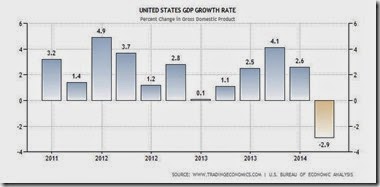

That could also be because of the horrible -2.9 percent decline in Q1 GDP growth, probably a sign that 2014 growth overall will not be all that great. Hence investors tend to leave the stock market and flee to bonds as a safe haven.

Whatever the reason, it doesn’t look like interest rates will rise anytime soon. The US housing market would have to pick up, as NAR chief economist Lawrence Yun keeps repeating. But there is little likelihood that will happen, unless market conditions improve.

“Sales should exceed an annual pace of five million homes in some of the upcoming months behind favorable mortgage rates, more inventory and improved job creation,” said Yun. “However, second-half sales growth won’t be enough to compensate for the sluggish first quarter and will likely fall below last year’s total.”

Also, since there is little or no inflation on the horizon, new Fed Chairperson Janet Yellen has vowed to keep interest rates as low as possible in her latest speeches and testimony before Congress. “For the moment, I don’t see any trade-off whatsoever in achieving our two objectives (growth with stable inflation). They both call for the same policy, namely, a highly accommodative monetary policy.”

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment