Popular Economics Weekly

Why start with motor vehicle sales? “Consumers weren't holding back in May when it came to buying cars and trucks which sold at a 17.8 million annual rate for a whopping 7.9 percent gain from April,” said Econoday re Tuesday’s motor vehicle report. Because it’s a sign consumers are more confident, ergo they must be feeling better about their jobs, ergo tomorrow’s U.S. Labor Department employment report should be very strong.

It’s the strongest vehicle sales since July 2005, believe it or not. And not due just to incentives and 100 percent financing offers, which have been available really since the end of the Great Recession. Until now consumers haven’t been spending what they are earning. April retail sales were punk. But the huge jump in vehicle sales should mean the start of the buying season for consumers, at last. Vehicle sales had declined four times over the past 6 months, as have sales in almost every economic sector.

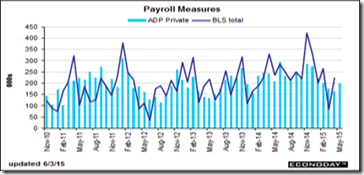

Another hint at stronger employment growth ahead is the monthly ADP private sector employment report out yesterday. Automatic Data Processing estimates that private payrolls rose a moderate 201,000 in May. For comparison, the consensus for private payroll growth in Friday's BLS employment report is a bit higher, at 215,000 with the low estimate at 185,000. It is another sign of employment growth that anticipates Friday’s more ‘official’ Labor Department unemployment report, in other words, which includes government as well as private sector jobs.

And perhaps the best indicator of future growth is the ISM non-manufacturing, or service sector index, which came in at 55.7, down from last month’s 57.8 percent, but showed improvement in exports and future hiring. New orders at 57.9 and business activity at 59.5 were particularly strong. Employment also slowed, down 1.4 points to 55.3 but it still points to employment growth.

Exports were up 6.5 points to 55.0 in a reading that highlights yesterday’s big service-sector surplus in the April trade report. Second-quarter GDP looks to be getting a lift by a decline in imports, which are a negative number in the GDP report since they are subtracted from exports. Exports are a positive measure that indicates how much is domestically produced. Imports fell 3.3 percent in April to $230.8 billion at the same time that exports were up 1.0 percent to $189.9 billion.

Note there was special strength for arts/entertainment/recreation and management & support services in the ISM report said Econoday, the latter one of the strongest export industries for the nation. And, both real estate and construction show strength. The only one of 18 industries to contract in the month was, once again, mining which is being hurt by low commodity prices (meaning cheaper gas and oil).

Another indicator of improved hiring was in the government sector, often overlooked. Gallup's U.S. Job Creation Index reached a new high of plus 32 in May, up from plus 31 in April. And “perceived” job creation in the government sector was at a new high, when government job creation has been the lagging indicator holding back overall employment. Within the government sector, the Job Creation Index score reached plus 25 in May. This is up from plus 22 in April and the previous high of plus 23 in August 2014.

This is extremely important, because the Obama administration has the worst record in recent history of government job creation (blue line in graph). The loss of some 800,000 government jobs is the major reason employment has grown so slowly post-Great Recession (though Obama is now second-best in overall private sector job creation, according to Calculated Risk).

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 688,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment, as we said.

Lastly, Jobless claims continue to run very low, down 8,000 in the May 30 week to 276,000 which is right at the Econoday consensus. The 4-week average is up slightly to 274,750 and is running about 5,000 lower than the month-ago comparison.

All these readings are at or near 15-year lows and indicate that the unemployment side of the labor market is very favorable. So look for a gangbusters employment report tomorrow, dare we say?

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment