Financial FAQs

The consumer came to life in May, boosted by a 0.5 percent rise in personal income and helping to support a 0.9 percent surge in personal outlays that reflects heavy spending on autos and retail goods. The spending surge will also boost housing, already showing much better numbers, and the rest of the economy this year.

This is while the gains are not inflationary, at least yet, based on the very closely watched core Personal Consumption Expenditure (PCE) price index which edged only 0.1 tenth higher in May and is at a very benign 1.2 percent year-on-year rate which is actually down a tenth from an upward revised April.

Also, consumer optimism is absolutely as strong as it gets well beyond forecasts to 96.1, according to the University of Michigan consumer sentiment index. The expectations component, reflecting strong optimism for the jobs market, is an absolute standout, at 97.8 for a 12-year high and an 11.0 point surge from mid-month and a 13.6 point surge from final May, said Econoday. The survey is now back to early 2000 levels in this graph that dates back to 1978 and five recessions.

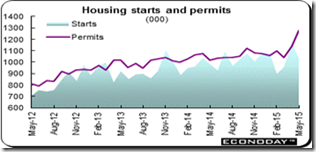

And such increased household incomes and employment have boosted housing construction and permits, which in turn boosts lots of ancillary sectors, such as Professional Services, Insurance, and Banking. Housing starts came in at a 1.036 million rate in May which is down 11.1 percent from the April rate, as we reported – but the April rate, which was already one for the record books, was revised even higher to 1.165 million for, and this is no misprint, a 22.1 percent gain from March.

Increased consumer optimism has to be why we see the gigantic surge in permits, up 11.8 percent to 1.275 million following a 9.8 percent gain in April, which means future construction growth. Permits are the leading indicator in the report and the latest permit rate is the best since way back in August 2007. Based if nothing else than on permits, the housing sector, following the heavy weather of the first quarter, is moving to the top of the economy.

For home buying, the 30 to 39 age group (blue line) is important in this Calculated Risk graph. The population in this age group is increasing, and will increase significantly over the next 10 plus years. From roughly 2020 this predominately home buying age group will outnumber all the other age groups in this graph that projects out to 2060.

This increase in the demand for goods and services, including housing, is in fact because of the millennial generation, as I’ve said in past columns. Its numbers have now surpassed their parents’ baby boomer generation, and will continue to expand as more become adults, enter the workforce, and raise families.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment