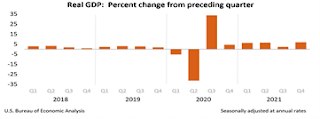

It looks like the Omicron variant has actually spurred higher growth. The fourth quarter GDP ‘first estimate’ of growth exploded to 6.9 percent, surpassing most estimates of 5 to 6 percent.

GDP got a big lift at the end of last year from businesses scrambling to restock empty shelves in time for the holiday season and warehouses hit by disruptions during the pandemic.

Massive government stimulus spending was a big help as GDP increased by 5.7 percent for the full year, before tapering in the final quarter. That’s the biggest gain since 1984.

The BEA said, “The increase in real GDP primarily reflected increases in private inventory investment, exports, personal consumption expenditures (PCE), and nonresidential fixed investment that were partly offset by decreases in both federal and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.”

Both businesses and consumers spent more, but the 24.5 percent increase in Q4 exports was the biggest surprise. It means other countries are buying more of our products and services, which is in turn a sign that their economies are recovering as well.

And consumer spending that powers two-thirds of economic activity rose a remarkable 3.3 percent in the fourth quarter, vs. 2 percent in the third quarter.

The value of inventories soared by $240 billion — one of the biggest increases in decades — as companies ramped up production to try to meet higher demand.

What does this tell us? That the main cause of inflation isn’t too many Federal Reserve $$ in circulation that has put pressure on the Fed to raise interest rates sooner rather than later.

The BEA noted that government aid has in fact decreased. Inflation should decline as the shortages of workers and supplies are reduced. Businesses will eventually catch up to the demand that is outstripping the supply of goods and services, in part because of new technologies such as 5G communication services coming online and chip shortages that are crimping the production of vehicles as well as other products dependent on said computer chips.

So although inflation is rising at 6.5 percent in December, according to the Personal Consumption expenditure (PCE) price index used by the Fed to measure inflation, businesses are racing to satisfy sizzling demand.

Will inflation keep rising, squeezing consumers, or return to a more normal range this year?

MarketWatch’s Jeffry Bartash says predictions are,

“…that the U.S. will grow strongly again — around 4% or so — in 2022 despite the end of government stimulus, especially if the coronavirus is kept at bay. The chief obstacles? Ongoing shortages of labor and supplies that have boosted inflation to a nearly 40-year high. Inflation-adjusted incomes actually fell at a 5.8% annual pace in the fourth quarter.”

But surging exports are a sign of a worldwide recovery in demand for American products and services, and that the supply bottlenecks will soon be a thing of the past.

It’s as if the Omicron variant is becoming a mere blip on the screen of future growth.

Harlan Green © 2021

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment