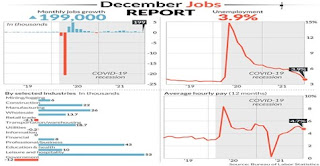

It is uncanny that just 199,000 nonfarm payroll jobs were created in one Labor Department establishment survey, while a separate and smaller household survey showed that 651,000 people found jobs in December after a 1.1 million gain in November.

This kind of variability is typical when the U.S. economy is nearing full employment. That and the soaring inflation rate (6.8 percent of late) show that the demand for goods and services is far outstripping supply at the moment.

The unemployment rate dropped to 3.9 percent from 4.2 percent—just above the fully employed 3.6 percent level before COVID-19 shut down the economy. So, the American economy is close to full employment even with the Omicron variant still scaring workers from returning to work.

The other question is when will producers catch up to soaring demand because the U.S. economy is showing a classic case of overheating at the moment.

The above Calculated Risk graph shows how quickly we have closed in on full employment—much faster than the 2001 and 2007 recessions (blue and brown lines in graph), for instance.

Supply will have a chance to catch up to demand and tame inflation when the Omicron variant is tamed.

The U.S. economy regained 6.5 million jobs in 2021, but employment is still short of the pre-pandemic peak by almost 4 million jobs. The U.S. employed 152.5 million people just before the pandemic erupted. Total employment rose to 148.9 million at the end of last year

Average hourly pay has risen 4.7 percent in 2021, which tells us that companies will pay whatever it takes to hire more workers.

Where are they hiring? Leisure and hospitality added 53,000 jobs, which means more people are eating out and traveling over the holidays. Professional businesses hired 43,000 people, manufacturers added 26,000 jobs, construction employment rose by 22,000 and transportation and warehouse firms beefed up payrolls by 19,000.

It’s good news that Americans are continuing to return to work and the economy is nearing full capacity. Please Fed Governors, let that picture sink in before you begin to raise interest rates, which would slow down this recovery from the worst pandemic in more than 100 years.

So, we should begin to enjoy the fact that this economic recovery has just begun, rather than worry about its growing pains.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment