Some inflation is good for growth since it boosts profits, but the short answer is when inflation becomes so prolonged that most consumers can only afford basic nesessities like food and shelter. And that hasn’t happened yet, with consumer spending still at post-pandemic highs.

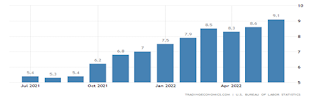

The annual inflation rate in the US accelerated to 9.1 percent in June of 2022, the highest since November of 1981, from 8.6 percent in May and above market forecasts of 8.8 percent.

It was mainly energy prices rising 41.6 percent, the most since April 1980, boosted by gasoline (59.9 percent), fuel oil (98.5 percent), electricity (13.7 percent, the largest increase since April 2006), and natural gas (38.4 percent, the largest increase since October 2005).

Consumer spending may have peaked but has yet to decline substantially in May. It is still up 7.2 percent overall, 5.2 percent YoY without more volatile food and energy prices per the FRED graph, which is causing most of the current inflationary spike.

So, how long can this surge in prices last, given the Ukraine war, China’s COVID problems, and the ongoing pandemic restrictions?

President Joe Biden on Wednesday said in a statement that while a "headline inflation reading is unacceptably high, it is also out-of-date," as he reacted to a report showing a year-over-year rise of 9.1% for the consumer price index in June. "Today's data does not reflect the full impact of nearly 30 days of decreases in gas prices, that have reduced the price at the pump by about 40 cents since mid-June,"

The fact that inflation may soften sometime in the future is a tough sell and hard for consumers to believe. What should we believe about the danger of longer-term inflation?

The analogy that I used last week that best describes current economic conditions (and inflation) is we are in a race to recover from COVID-19 while a European war is raging. The U.S. economy has slowed from a warp speed of 100 mph as it shot out of the pandemic to 60 mph, as it returns to a more normal growth mode.

Gas and oil prices are moderating because most of the oil-producing companies and countries have increased production for the simple reason that they are making record profits.

And consumers will slowly cut back on spending as prices continue to rise across the board. Friday’s retail sales figures for June will tell us how much consumers are cutting back. If spending is slowing, perhaps the Fed will also slow down the timing of their next rate boosts.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment