“Real gross domestic product (GDP) decreased at an annual rate of -0.3 percent in the first quarter of 2025 (January, February, and March), according to the advance estimate released by the U.S. Bureau of Economic Analysis. In the fourth quarter of 2024, real GDP increased 2.4 percent.”

It’s President Trump’s economy now after the first 100 days of his second term.

The U.S. economy contracted in the first quarter of 2025 for the first time in three years, reflecting a surge in imports ahead of President Donald Trump’s tariffs and a slowdown in consumer spending.

The BEA graph of economic growth from Q4 2023 tells us all we need to know to compare President Biden’s economic record and Trump’s misrepresentations and lies of his economic record as president. Biden had an average growth rate of +3.2 percent over his term vs. Trump’s -0.3 percent contraction in the first quarter 2025. And it can’t get much better, because worldwide tariff wars take a long time to settle.

Is this what Americans wanted in re-electing Donald Trump, who has proven once again after failed casinos, Trump University, and countless lawsuits, he has never been a successful businessman?

The real question is how could so many Americans been fooled into thinking Trump knew what he was doing?

Some supporters believed that because economic growth was positive in Trump’s first term he could repeat his performance. But in fact, it followed President Obama’s eight years of investments that boosted the recovery from the 2008 Great Recession, the worst recession since the Great Depression.

How could it have been different, since Trump based his whole economic policy on his most blatant lie, that tariffs were not a tax on imports that would be paid by American importers and consumers, hence were not inflationary when he promised to bring down the price of groceries on ‘Day 1’.

Americans can now look behind Trump’s curtain of lies with the first actual reading on Trump’s economic record. Joe Biden’s economy was one of the strongest since World War Two, aided by the passing of bipartisan legislation that renewed our infrastructure, mitigated climate change and strengthened our social safety net, legislation that was equivalent to Roosevelt’s New Deal.

We can also see clearly that Elon Musk’s DOGE is attempting to tear all of this down by illegally firing the government employees and cutting the funds that congress appropriated to implement Biden’s New, New Deal

The American public can also see Republicans’ real goal in the current budget negotiations—continuing to grow the wealth of its Oligarchs by cutting taxes, while taking away the services that benefit all Americans.

Economic growth will continue to shrink, in other words. The ADP National Employment Report of private job creation just out for April shrank to 62,000 from 147,000 jobs in March, presaging what will happen with the upcoming official U.S. unemployment report for April.

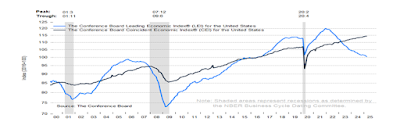

Consumers have also pulled back their spending, a sure indicator of a possible recession. And the Conference Board just reported another record drop in consumer confidence.

“Consumer confidence declined for a fifth consecutive month in April, falling to levels not seen since the onset of the COVID pandemic,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “The decline was largely driven by consumers’ expectations. The three expectation components—business conditions, employment prospects, and future income—all deteriorated sharply, reflecting pervasive pessimism about the future.”

We must now face the fact that President Trump has already damaged the most powerful economy and country in the world with his lies and incompetence.

What’s next? He answered in an interview with The Atlantic,“The first time, I had two things to do — run the country and survive; I had all these crooked guys,” Trump said. “And the second time, I run the country and the world.”

Really? The American public is already answering President Reagan’s famous dictum, “Are you better off today than you were four years ago.” with a resounding NO!

Harlan Green © 2025

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen