“Any tariff causes consumers to shift from imported goods to domestically produced alternatives that are more expensive, inferior in quality, or just not quite what they want. But with a low tariff domestic alternatives will be only a little bit worse than the imports they replace; with a high tariff many of the domestic goods consumers buy will be a lot worse than the imports they replace. Nobelist Paul Krugman

Federal Reserve Chairman Jerome Powell said in his latest remarks that the Trump tariffs were much higher than the Fed had expected. It has unsettled the financial markets so much that Fed officials don’t know whether it’s smarter to lower or raise interest rates.

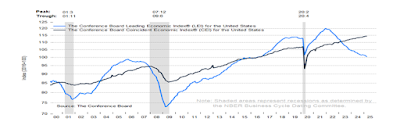

The Conference Board’s Index of Leading Economic Indicators (LEI) gives one read of our economic future for the rest of the year. And it’s pointing to stagflation rather than recession.

“The US LEI for March pointed to slowing economic activity ahead,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “March’s decline was concentrated among three components that weakened amid soaring economic uncertainty ahead of pending tariff announcements: 1) consumer expectations dropped further, 2) stock prices recorded their largest monthly decline since September 2022, and 3) new orders in manufacturing softened.

The stock and bond markets continued to decline on the Monday after Easter—the DOW down -972 points. So, no sign of an economic resurrection there. The stagnation component is because Trump is fighting an imagined immigration war that is reducing our workforce, which is causing a labor shortage during a time of full employment. The two to three million surge in new immigrants during Biden’s term made US the fastest growing economy in the world.

And the tariff war will bring create bottlenecks once again as it did during the COVID-19 pandemic, which is when it caused the inflation component of stagflation to skyrocket and the Fed to raise interest rates to combat it.

It’s becoming more obvious what Trump means by using his “gut’ to make decisions. It’s why his “batshitcrazy” tariff decisions, in the words of Paul Krugman, are causing such chaos. Foreign governments can’t make decisions on gut instincts and so are pulling their U.S. investments, causing the stock and bond selloffs. Gold is the current flight to quality shelter in lieu of the traditional bond play.

That means he lives by his own Laws of the Jungle, where might Trumps right, and only knows how to bully rather than reason. So it’s no surprise that Trump lurches from one tariff proposal to another without researching any of its effects, causing world markets to lose faith in the full faith and credit of the U.S. Dollar and Treasury bonds.

Adam Posen, a former official at both the Federal Reserve and the Bank of England, said in a speech this week that the U.S. could suffer the biggest “stagflationary” shock in decades.

“We may get recession, we may not, but we are going to get inflation either way,” he said, as cited by MarketWatch. Even if Trump strikes deals with various countries, tariffs are likely to remain in place (at least 10 percent). These measures would raise prices, increase inflation and slow the economy — the recipe for a period of stagflation.

Harlan Green © 2025

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment