Financial FAQs

The short answer is that higher inflation comes from higher growth rates, and so when an economy expands faster, then prices should also rise faster. Otherwise companies’ profits don’t rise and they won’t want to expand their businesses and so hire more workers.

But pundits and some economists keep focusing on the expectations of future inflation, even when current conditions don’t warrant such expectations. It’s as if those folks are afraid of faster growth, when that is exactly what is needed. Everyone, including the IMF and Federal Reserve in its latest update, believes US GDP growth will average no more than 2 percent this year.

This is a pitiful growth rate, and we know why this is happening. Consumers, though they have paid their debt down to pre-Great Recession levels, aren’t earning any more money after inflation. Earnings are also increasing just 2 percent.

And governments aren’t generating more jobs that only governments can generate—such as in public infrastructure, education (more teachers), research and development that pays for future growth, and environmental protection that must mitigate some of the effects of global warming, such as the thousands of miles of US coastline affected by rising oceans.

That is the gist of Janet Yellen’s pronouncements after yesterday’s FOMC meeting. We must allow inflation to rise above the 2 percent level with the PCE inflation index used by the Fed.

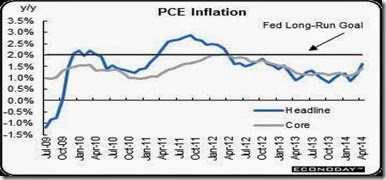

Year-on-year Personal Consumption Expense prices are increasing at plus 1.6 percent and 1.4 percent for the core without food and energy prices. While inflation is still below the Fed goal of 2 percent, it has been firming in recent months.

But Fed Chair Yellen suggested that growth was too slow to worry about incipient inflation, which meant the Fed wouldn’t have to raise rates for some time to come. That’s because the central bank expected 1.5 to 1.7 percent inflation in 2014, nearly identical to their forecast in March and a level below their target.

Responding to a later question, she said: “For the moment, I don’t see any trade-off whatsoever in achieving our two objectives (growth with stable inflation). They both call for the same policy, namely, a highly accommodative monetary policy.”

Then who is actually worrying about inflation? Hardly anyone, including the Fed Governors. So the answer is that higher inflation is a good thing when it's necessary to boost higher growth, which in turn will create more jobs, which is turn boosts more growth. So it is low inflation--and low inflation expectations--that is the problem to be solved. Why should anyone fear a higher growth rate?

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment