The Mortgage Corner

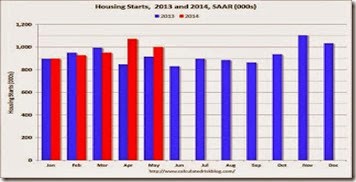

“An uptick in single-family permits was probably the most important feature of a May residential construction report that was otherwise somewhat softer than our forecast,” says the research firm, Wrightson ICAP. Total housing starts fell 6 percent to a level of 1.001 million, reversing about half of a 13 percent April jump. Construction fell in three out of the four regions, but were up in the South.

The reason was overall permits fell 6 percent, or about twice as much as Wrightson had expected, reflecting a nearly 20 percent decline in the multi-family component. That left those permits at a four-month low, but “we are not too concerned with the decline, which looks to be a correction for a very strong April showing in this always-volatile sector,” said Wrightson.

The standout number in today’s report was the 4 percent rise in single-family permits to a six-month high of 619,000. After hitting a recovery high of 645,000 in November, single-family permits had been stuck in a tight range of 593K to 600K over the last four months. The breakout in May, along with the jump in the NAHB Builder Optimism index to 49 in June, seems to suggest that single-family activity could be about emerge from its recent doldrums over the next few months.

Builder confidence in the market for newly built, single-family homes rose four points in to reach a level of 49 in the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released yesterday. It remains one point shy of the threshold for what is considered good building conditions.

“Consumers are still hesitant, and are waiting for clear signals of full-fledged economic recovery before making a home purchase,” said NAHB Chief Economist David Crowe. “Builders are reacting accordingly, and are moving cautiously in adding inventory.”

One reason consumers are cautious is because interest rates have risen slightly, though the 30-year conforming fixed rate is still low, at 4 percent with 0 origination points in California. The Federal Reserve added more fuel to the controversy after yesterday’s FOMC meeting and Fed Chairman Janet Yellen’s press conference, when Yellen said short term rates could now rise sooner in 2015.

But the Fed also revised its growth predictions downwards, which would have the opposite effect—that of holding down interest rates longer! In fact, just two days after the International Monetary Fund revised its 2014 growth estimates for the U.S. economy from 2.8 percent to 2 percent, FOMC members revised down their estimates from a range of 2.8 to 3 percent in March to 2.1 percent to 2.3 percent following this most recent FOMC meeting. But the Fed maintained its 3 percent growth estimate for 2015.

So I predict such a low growth rate will not push up interest rates, at all. In fact, mortgage rates in particular could even drift lower by the end of this year, unless the housing market—construction in particular—picks up.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment