Popular Economics Weekly

The International Monetary Fund just came out with a depressing prognosis for US economic growth—2 percent this year, and maybe 3 percent next year? Why? A too bad winter, slowdown in the housing market, and stagnant wages.

But both housing and economic growth in general are dependent on growing incomes. So we need a higher minimum wage, for starters. Some of the richest cities are doing that. Seattle raised its minimum wage to $11 per hour. But overall household incomes aren’t rising faster than inflation, and congressional Republicans are resisting any raises, even though it would benefit the poorest states they control.

In fact, both household incomes and inflation are also rising just 2 percent per year, when they would need to rise 3 to 4 percent to boost growth and lower the unemployment rate further, currently 6.3 percent.

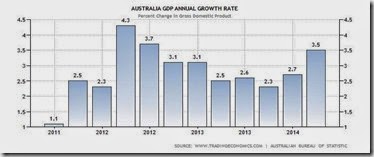

We only have to look to countries with a higher minimum wage to see what a difference it makes. Australia’s minimum wage is now $16.35 per hour for fully employed adults, whereas ours is still $7.25 per hour, nationally. And so Australia’s growth rate is averaging 3.5 percent per year. If we achieved that growth rate again, social security would be solvent as far as we can look into the future, say economists.

More evidence that higher wages stimulate growth comes from comes from many sources, including Thomas Piketty’s Capital in the Twenty-First Century, that documents 2 centuries of income and wealth transfers, and the return to historical levels of income inequality that is hurting economic growth.

And a new paper argues inequality is not only bad for those at the bottom. It is also bad for economic growth as a whole and a major reason why the recovery from the Great Recession has been so weak.

It is synopsized in a Washington Post article that attacks inequality vs. economic growth directly. Barry Z. Cynamon and Steven M. Fazzari, economists working with the Weidenbaum Center on the Economy, Government and Public Policy at Washington University in St. Louis, say that stagnant income for the “bottom 95 percent” of wage earners makes it impossible for them to consume as they did in the years before the downturn.

Consumer spending which drives 70 percent of the U.S. economy, dropped sharply during the recession (gray column in graph). And while it has picked back up in the years since for the top 5 percent of wage earners — which the Census Bureau defines as households making more than $166,000 a year — “there is no evidence of a recovery whatsoever for the bottom 95 percent,” Fazzari said.

Raising the minimum wage isn’t the best answer, of course. Creating programs that promote more jobs is the best answer to boosting wages and salaries of the 95 percent. And that has to start with government that needs to replace and repair our ageing roads, bridges, and all public infrastructure, for starters.

That’s because our private sector banks and corporations are still hoarding their cash reserves, or sending them overseas. It’s more than $5 trillion at last count, and that means a real loss of wealth and jobs for those Americans that need it most.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment