Popular Economics Weekly

If we really want to know what is depressing consumers, look at how Congress is tied up in knots over the debt ceiling and spending losses from sequestration cuts--$109 billion per year, according to labor economist Jared Bernstein.

Former CIA assistant director Mike Morell on CBS’s 60 Minutes said he didn’t understand why congressional Democrats and Republicans couldn’t work together to boost economic growth for “the good of the country” when our weak economy was the greatest problem facing US, above even terrorist threats.

“I don’t understand the inability of our government to make decisions that push our economy and society forward,” he said. “Our national security is more dependent on the strength of the economy and society than anything else.”

But for “the good of whose country” are we talking about? We seem to be living in two countries at the moment, mainly divided into anti-government Republican Red states and pro-government Democratic Blue states. Most of the Red states adamantly oppose the expansion of voters’ rights, union collective bargaining, better healthcare, immigrants’ rights, environmental regulation, abortion and women’s rights, for starters.

Government gridlock not only endangers our security, but the resultant inequality endangers our democratic system itself. The CIA should know, as it has kept track of the economic well-being of nations in its World Factbook. The U.S. now ranks below other developed countries in income equality, birth-death rates, longevity, and health outcomes.

The problem today is the huge amount of damage gridlock is doing to economic growth, from downgrades of government debt by Standard & Poor’s rating agency, to higher borrowing rates. Even Moody’s has put U.S. debt on credit watch. The Red and Blue states seem to be fighting the Civil War all over again, after 150 years, as I’ve said.

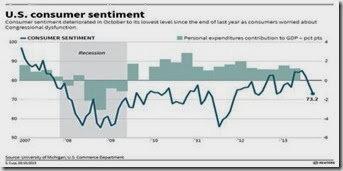

The latest evidence of the damage being done is orders for a wide range of U.S.-made capital goods plummeted in September and consumer sentiment weakened sharply in October, signs that the budget battle in Washington has held back the economy, said Thomson-Reuters. The Thomson Reuters/University of Michigan's final reading on the overall index on consumer sentiment fell to 73.2in October from 77.5 in September and was the lowest final reading since December 2012.

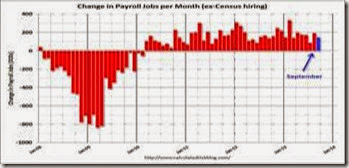

Then we have the latest unemployment report that showed more workers dropping out of the labor force, while the Labor Department’s JOLTS report of labor layoffs and hires remained stagnant over the past year.

There were 3.883 million job openings on the last business day of August, up from July at a revised 3.808 million. The job openings rate improved slightly to 2.8 percent from 2.7 percent in July. But it has leveled off after increasing steadily since the end of the Great Recession.

So the question is, government should work for the “good of whose country”? Tea Partiers want to take back “their” country, a country that no longer exists. If that is their sentiment, how do we push our country and society forward?

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen

![clip_image002[6] clip_image002[6]](http://lh5.ggpht.com/-j__C6jnz2fY/Ul7696nf5YI/AAAAAAAAEGo/sYGHP5eNUWI/clip_image002%25255B6%25255D_thumb%25255B3%25255D.jpg?imgmax=800)