Calling a recession at this time because we may have two consecutive quarters of negative GDP growth is almost irrelevant, because it may be over as quickly as the artificially induced 2-month recession in April-May 2020 (see thin gray bar in above graph) when the pandemic was building a head of steam.

Record growth followed last year because of the $6 trillion in government largesse, and consumers are beginning to have a hangover from the record spending spree that has ignited this inflation spike.

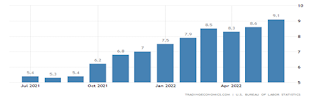

So how do we determine when and if the next recession that everyone is predicting will happen? I like to follow consumer confidence surveys, because as the above graph indicates, consumer confidence closely tracks recessions.

The Conference Board’s monthly survey has been trending down since January, just as has GDP growth. It’s the simplest way for the lay person to see the larger picture, since consumer spending makes up approximately two-thirds of economic growth—and it continued to decline in July.

The Conference Board just announced its Consumer Confidence Index® decreased in July, following a larger decline in June. The Index now stands at 95.7 (1985=100), down 2.7 points from 98.4 in June. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell to 141.3 from 147.2 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—ticked down to 65.3 from 65.8.

“Consumer confidence fell for a third consecutive month in July,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The decrease was driven primarily by a decline in the Present Situation Index—a sign growth has slowed at the start of Q3. The Expectations Index held relatively steady, but remained well below a reading of 80, suggesting recession risks persist. Concerns about inflation—rising gas and food prices, in particular—continued to weigh on consumers.”

“As the Fed raises interest rates to rein in inflation, purchasing intentions for cars, homes, and major appliances all pulled back further in July” continued Franco. “Looking ahead, inflation and additional rate hikes are likely to continue posing strong headwinds for consumer spending and economic growth over the next six months.”

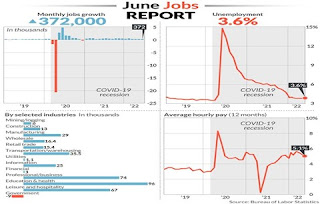

U.S. retail sales rebounded strongly in June as Americans spent more on gasoline and other goods amid soaring inflation, so their ‘headache’ hasn’t yet spread to most businesses, as they continue to create jobs and the unemployment rate is still at a record low. It’s difficult to call a recession with a fully employed economy, in other words.

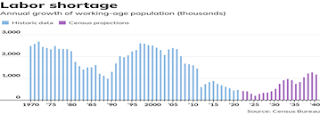

So, I’m going to make a rash prediction. This recession has already begun for the simple reason that growth has stalled, and several indicators used by the National Bureau of Economic Research are already trending down. Consumer spending and personal incomes are beginning to decline and industrial production is also slowing.

What has caused the inflation surge since February, and sudden rise in gas and food prices that worry consumers? The Ukraine invasion, of course, followed by China’s inability to control its own COVID epidemic.

We will reach bottom in this growth trough and begin to uptrend again when the Ukraine, Russia and China resolve their various issues that are restricting supplies of almost everything that consumers depend upon.

And who knows when this might happen? The whole world wants it to happen, so maybe enough pressure will be applied to end the Ukraine conflict and encourage the Chinese to fix their COVID problem so that the world can return to what is the real problem, global warming that has far worse consequences than a temporary and artificially induced recession.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen