Popular Economics Weekly

Bloomberg Businessweek recently highlighted under the banner, “The Most Feared Man in Washington is…” a profile of Grover Norquist, the chief “Enforcer” of the no new taxes pledge taken by 233 of the 240 House Republicans crafted during House Speaker Newt Gingrich’s era of the Contract for America. The pledge binds all of its takers to oppose “any and all efforts” to increase marginal income tax rates and to protect tax deductions and credits, according to Businessweek.

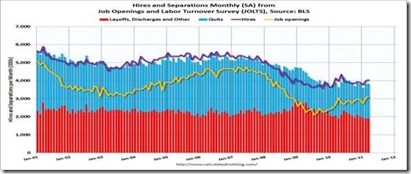

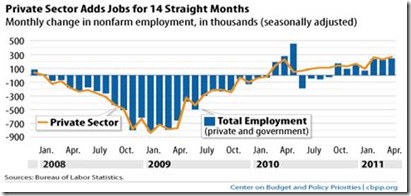

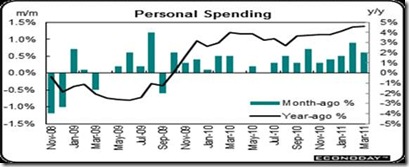

But in fact this pledge has not succeeded in its stated goal of lowering government spending. In fact, it has mainly succeeded in starving the main engine of economic growth, consumers. For each time Republican administrations have cut taxes in the name of shrinking government, it has instead shifted wealth from the lower and middle income classes to the top income brackets, which lowers the overall demand for goods and services.

As former Reagan Budget Director David Stockman said in a April 25 New York Times Op-ed, “While not the stated objective of policy, this reverse Robin Hood outcome cannot be gainsaid: the share of wealth held by the top 1 percent of households has risen to 35 percent from 21 percent since 1979, while their share of income has more than doubled to around 20 percent.

Why hasn’t the no new taxes pledge succeeded? Because Republicans are no better at cutting government spending than Democrats—in fact worse. Republican administrations since Reagan have chosen to borrow to pay for their hot and cold wars, rather than sharing the sacrifice, driving us ever deeper into debt.

There are other reasons for slower growth, of course. A slower growing population with more seniors, saturated consumer markets (more than 2 cars in a garage?), are two of the reasons. But during the period 1951-63, when marginal rates were at their peak—91 to 93 percent—the American economy boomed, growing at an average annual rate of 3.71 percent. The fact that the marginal rates were what would today be viewed as essentially confiscatory, says New York Times’ pollster Charles Blow, did not cause economic cataclysm—just the opposite: “Whereas during the past seven years, during which we reduced the top marginal rate to 35 percent, average growth was a more meager 1.71 percent.”

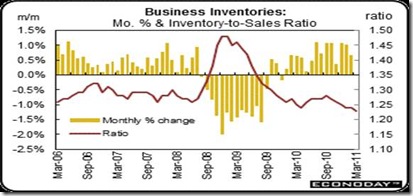

Which brings us back to the federal deficit, the reason we are debating methods to starve the beast of government spending in the first place. It was caused first and foremost by the Bush-era tax cuts to the highest marginal tax rates, and on dividends and capital gains earned by the investor class. This in addition to the 2 wars has cost us more than $3 trillion in borrowed money to date, and the reason our deficit is still growing.

Grover Norquist, a Harvard MBA business degree graduate, has chosen to do his economic jousting without even the most basic knowledge of economics, it seems. Economic demand theory teaches that taking money from the pockets of those who spend most of it and transferring it to those who save most of it doesn’t increase demand for products.

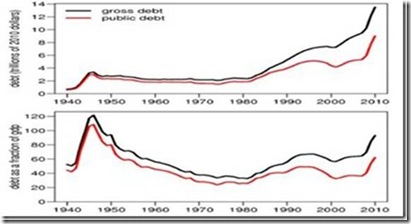

Economic historians in particular know that tax cuts without sending cuts do not lower deficits, period, since it chokes off the revenues needed to pay down the deficit. The two largest expansions of debts as a percentage of GDP were during the Reagan and Bush Presidencies—from a low of 47 percent in the 1970s to its current some 80 percent. They were also the administrations that did the most tax cutting, without comparable spending cuts.

Nor do tax cuts—particularly to the highest marginal tax rates—stimulate more growth. In fact, we have seen a historical drop in GDP growth since the decline in highest marginal rates (of 93 percent) that prevailed during the Eisenhower administrations. The only time we have seen a real decline in the federal budget deficit was during the Clinton Presidency, when Clinton and Congress agreed to maintain Pay as You Go budget rules that said spending had to match revenues. The highest marginal tax rate was raised to 39 percent while government spending as a percentage of GDP fell during the Clinton era, so that the annual deficit was actually erased from 1997 to 2001.

Alas, President Reagan wanted to outspend the Russian military, while the GW Bush wanted to invade Iraq without spreading the pain. Instead, he made the call after 9/11 for everyone to go shopping. The problem was that shifting so much wealth to the wealthiest shortchanged consumers, who had to borrow beyond their means to take his advice.

When will we learn the lessons of history? Grover Norquist may be “the most feared man in Washington…” only because we are doomed to repeat our historic mistakes, if we do not now understand how and why the federal deficit was created.

Harlan Green © 2011