Financial FAQs

Romney’s “Five Point Plan to Grow the Economy” that he touts on his website, is primitive economics almost beyond belief. It returns us to 19th century government of the few by the few with few regulations or insurance against the kinds of events that brought on the Great Depression and Great Recession, for starters.

Conservatives in general and Mitt Romney don’t seem to understand the most basic concept of modern economics--insuring against major disruptions—that is indispensable to run a modern economy. Insurance isn’t only about insuring the many to protect the most vulnerable—whether against physical disasters such as the Midwest drought, or financial disasters such as the Great Depression, or catastrophic illness. It is really about all of our citizens being for one, and one for all. It is why we tax ourselves to pay for a government, because government is really the protector of last resort against the most basic risks in a world grown increasingly complex and uncertain.

Modern economies can’t do without it, yet Romney says he opposes most modern forms of protection in his 5-point plan by continuing to reduce taxes that would starve government of revenues, as well as cap spending on regulation enforcement. He would also repeal the Affordable Care Act that insures 30 million more Americans. Instead he proposes more of GW Bush’s ‘Ownership Society’ which seeks to return us to the era of laissez faire, free, unregulated markets that existed 100 years ago. And we know the damage those institutions which evaded or ignored modern financial regulation did to financial markets.

Then was a much smaller, less complex world where most Americans were still living on farms. But the farming world collapsed in the 1920s when mechanization caused farming prices to plunge, ultimately bringing on the Great Depression. That is when the modern, industrial world came into being, requiring New Deal insurance; including social security, unemployment insurance, and even workman’s compensation to cushion the effects of modern business cycles on the urban unemployed who could no longer return to the farm during tough times. And unions came into being to organize workers so they could bargain for better than minimum wages and benefits.

The centerpiece of Romney’s plan is to continue to cut taxes for both individuals and corporations. This is when corporations have the highest profits as a percentage of GDP in history, while most individual tax cuts have benefited the wealthiest, thus creating the worst income inequality since the 1920s.

Graph: CBPP

And in starving the government of revenues he would impose a regulatory budget cap, “reform” regulations so that coal-fired power plants would no longer have to control their pollution (thank you, Koch Brothers, for your $millions in contributions), open ANWAR, the Arctic National Wildlife Preserve to oil drilling, and in general continue to support our most polluting, non-renewable energy resources.

Returning the U.S. to an almost primitive society is already happening, of course, with continuing Republican attempts to block Dodd-Frank regulation, privatize Medicare and social security. The Great Recession was a product of Adam Smith’s primitive economic theory that said an ‘invisible hand’ controls markets for the benefit of all.

Really? That hasn’t been the case during the past two GW Bush recessions, including the Great Recession. $Trillions were lost during those recessions that were the result of inflated asset bubbles bursting, as regulations were ignored or evaded which controlled financial risk-taking. The Bush record is not pretty, and that is the most recent record to look at that is the result of primitive economic thinking.

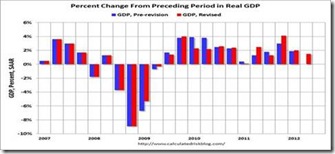

Graph: Calculated Risk

The historical graph of economic growth shows most clearly which policies work to grow the economy—primitive economic policies, or using government as an active participant in growth? In fact, all recent recessions since 1980 have occurred during Republican administrations; from President Reagan’s in 1980, 1983, Bush I in 1991, and GW Bush in 2001 and 2007-09. Policies that starve government of what is needed to govern effectively starves all of U.S. Need we say more?

Harlan Green © 2012