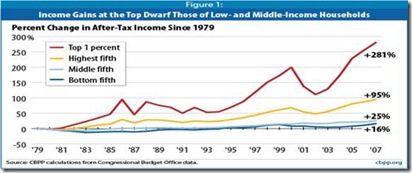

The U.S. Census Bureau recently reported one in seven Americans are living in poverty, today -- the highest level since 1994. And that is why this is such a deep recession. Economists agree that economic growth is driven by what they call aggregate demand—the sum of government and private sector spending and investment. And since about 70 percent of economic activity is driven by consumers, less money in their pockets means lower demand, ergo, slower growth.

An estimated 43.6 million Americans in 2009 were living off incomes below the federal poverty line, or around $11,000 for an individual under 65 or $22,000 for a family of four. The total number, an increase of 3.7 million over 2008, is the largest in 51 years, since the government first started tracking poverty data. And that is why we are so slow to recover.

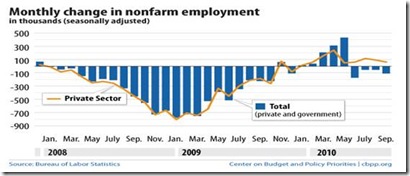

"The deterioration in the labor market from 2008 to 2009 was the worst we've ever seen," said economist Heidi Shierholz of the Economic Policy Institute. "When you see a big deterioration in the labor market, poverty rises. The vast majority of people in this country depend on the labor market for their income."

A loss of medical insurance is a big factor in the rising poverty, which isn’t projected to come down for several years, according to CBPP, The Center for Budget and Policy Priorities. "The number and percentage of Americans without health insurance rose sharply in 2009. The number of uninsured jumped by 4.3 million, to a total of 50.7 million. The percentage of Americans without coverage rose from 15.4 percent to 16.7 percent, which means one of every six Americans was uninsured last year. These are the sharpest year-to-year increases since the Census Bureau began collecting these data in 1987.”

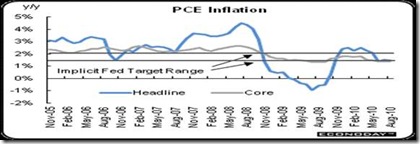

With news from the National Bureau of Economic Research that the Great Recession actually ended in June 2009, those consumers with jobs might improve. The consumer is opening his wallet wider as the pace of retail sales has picked up. Although auto sales led a September gain, strength is broad based. Overall retail sales in September advanced 0.6 percent, following a 0.7 percent gain in August (revised up from 0.4 percent) and a 0.5 percent increase in July (previously 0.3 percent).

The NBER has said there will be no double dip, and that any future downturn will mean a new recession and not continuation of the present one. Two side-by-side recessions haven’t happened since Ronald Reagan’s tenure—in 1981 and 1983, when interest rates were still in the double digits—not the case now.

A consumer sector that is posting moderate gains in spending will likely support continued modest growth in the recovery. It's certainly not gangbusters, but the news is welcome relief for those worried about the economy becoming too sluggish or turning negative again.

And consumer debt may be plummeting to a level that makes them comfortable to spend again. Consumer credit contracted for the sixth month, down $3.6 billion in July. Revolving credit fell $4.4 billion, offset in part by a $0.8 billion rise in nonrevolving credit that got a boost from July's strength in car sales. Yet the secular decline in revolving credit is what's most important, reflecting the fundamental shift in the consumer who, hit by a weak labor market and lack of confidence in the economy, is less able and less inclined to fund discretionary purchases with a credit card.

The key is total debt to household income ratios that the Fed publishes. It has dropped to the Q3 of 2002 level—now 15.93 percent of household income, from 17.64 percent in Q1 of 2008. And in fact absolute household debt has contracted even faster, as household incomes (the denominator of equation) have been declining as well.

Another sign of increased hiring, is that initial claims for unemployment insurance are now down to 434,000, as of October 23, the lowest total since July. The four-week average posted its sharpest decrease of the year, down 39,000 to a 445,000, while continuing claims for the October 16 week fell 122,000 to a two-year low of 4.356 million. This comparison points to strength for monthly payrolls.

That, and other indicators show a tremendous pent-up demand for skilled workers is developing. For example, the international accounting firm Deloitte-Touche just announced they will be hiring 50,000 new employees per year over the next five years. With 169,000 people in over 140 countries, Deloitte member firms already serve more than 80 percent of the world's largest companies as well as large national enterprises, public institutions and successful fast-growing companies, says its website.

Much of consumer behavior is controlled by their feelings—consumer confidence, in a world where the future is becoming harder to predict. And with poverty levels so high due to the slack labor market, those feelings are mainly determined by what consumers see as their job prospects.

So we can only hope that initial jobless claims continue to drop, which can only help those record numbers having to live at the poverty level. Only more emphasis on job creation can bring those improvements.

Harlan Green © 2010