Why should it be a surprise that Americans are still fighting the Civil War? Though it is no longer Generals Ulysses S Grant vs. Robert E Lee, it is still being fought with guns, as the latest Uvalde and Buffalo Supermarket carnage with military style assault rifles makes plain.

This is while Canadian Prime Minister Justin Trudeau has just banned the sale of handguns because of rising run violence in Canada! He said, ‘There is no reason anyone in Canada should need guns in their everyday lives’.

The signs of a active civil war are everywhere; with red states wanting almost anyone over 18 years of age to own an assault rifle in the name of a well-armed militia (Florida is the exception at 21 years old after the Parkland, Marjory Stoneham Douglas High shooting); with most of the Republican Party, the party of Lincoln, fomenting theories that colored peoples are inferior in some way; and their denial of President Biden’s win.

And then we have the last President’s followers’ blatant attempt on January 6 to overturn the election results.

It has been states’ rights vs. the Federal government since our founding: with red states keeping most of its citizens poor by denying benefits such as expanded federal health care and union organizing efforts that would boost wages with right to work laws.

Nobel Prize-winner Paul Krugman once highlighted why the poorest states tend to elect conservative politicians, who have not enhanced the economic opportunities of their own constituents.

“And what these severe conservatives hate, above all, is reliance on government programs,” says Krugman. “Rick Santorum declares that President Obama is getting America hooked on “the narcotic of dependency.” Mr. Romney warns that government programs “foster passivity and sloth.” Representative Paul Ryan, the chairman of the House Budget Committee, requires that staffers read Ayn Rand’s “Atlas Shrugged,” in which heroic capitalists struggle against the “moochers” trying to steal their totally deserved wealth, a struggle the heroes win by withdrawing their productive effort and giving interminable speeches.”

But perhaps we have suffered the most casualties in our ongoing civil war from the COVID pandemic.

A NYTimes article by Damien Caves highlighted a study of how Australia, a country very similar to the U.S. in demographics, had a much better outcome from the COVID-19 pandemic. In Australia and in the United States, the median age is 38. Roughly 86 percent of Australians live in urban areas, compared with 83 percent of Americans.

It was as much about having a culture of trust, he said, a culture that recognizes caring for others is as important as caring for oneself because it saves more lives, especially during disasters.

“If the United States had the same Covid death rate as Australia,’ said Cave, “about 900,000 lives would have been saved (vs. one million American lives lost to date). The Texas grandmother who made the perfect pumpkin pie might still be baking. The Red Sox-loving husband who ran marathons before Covid might still be cheering at Fenway Park.”

Instead of trusting each other to do the right thing, many Americans, and past-President Trump as a matter of policy, chose to distrust science and advocate every kind of snake oil cure, as if we were still living in the 1800s.

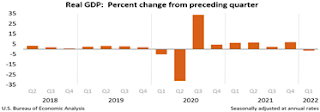

“In global surveys, Australians were more likely than Americans to agree that “most people can be trusted” — a major factor, researchers found, in getting people to change their behavior for the common good to combat Covid, by reducing their movements, wearing masks and getting vaccinated. Partly because of that compliance, which kept the virus more in check, Australia’s economy has grown faster than America’s through the pandemic,” continued Cave.

Every country has probably had a civil war sometime in its past, as part of its growing pains. Europe has certainly had it share, such as The Hundred Years War. And civil wars have always pitted brothers and sisters against each other.

But why have an ongoing civil war that has lasted 157 years and made lives worse for everyone, since 1865 and the abolition of slavery. Isn’t it time for US to put our guns away and make peace with each other?

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen