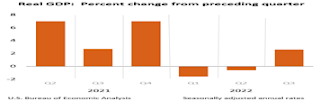

The U.S. economy grew 2.6 percent in the third quarter due to exploding exports, declining imports after two quarters of negative growth from the aftereffects of the pandemic, and record GDP growth in 2021.

‘The increase in exports reflected increases in both goods and services,” said the Bureau of Economic Activity (BEA). “Within exports of goods, the leading contributors to the increase were industrial supplies and materials (notably petroleum and products as well as other nondurable goods), and nonautomotive capital goods. Within exports of services, the increase was led by travel and "other" business services (mainly financial services). Within consumer spending, an increase in services (led by health care and "other" services) was partly offset by a decrease in goods (led by motor vehicles and parts as well as food and beverages).”

Travel and leisure activities jumped because Americans fled their homes after two years of pandemic restrictions. Consumer spending held up and spending on capital goods, a good sign of future growth prospects, increased at a 10.8 percent pace, but investment in structures and new housing sank as soaring mortgage rates choked off home sales.

Housing remains the worm in the apple of future growth, and a reason there are predictions of some level of recession next year, because housing construction and sales feed so many other sectors, such as insurance, banking and other professional services, as well as causing homeowners to feel less wealthy, the so-called wealth effect that can imduce consumers to spend less.

For instance, sales of new single‐family houses in September 2022 were at a seasonally adjusted annual rate of 603,000. This is 10.9 percent below the revised August rate of 677,000 and is 17.6 percent below the September 2021 estimate of 732,000, said the Census Bureau.

More importantly, the inflation rate has already declined. The price index for gross domestic purchases increased 4.6 percent in the third quarter, compared with an increase of 8.5 percent in the second quarter. The decline mostly stemmed from a sharp drop in gasoline prices, said the BEA.

This is the disinflation we have been speaking of where the rate of inflation is declining, but it’s not outright deflation when overall prices are actually falling, a sign of recession. It is indicative of a soft landing, a desirable outcome the Fed and economists are looking for.

Inflation fell even more for consumers as the Personal Consumption Expenditure (PCE) Index that measures consumer spending increased 4.2 percent, compared with an increase of 7.3 percent in Q2. Excluding food and energy prices, the PCE price index increased 4.5 percent, compared with an increase of 4.7 percent.

Inflation would decline more quickly if not for the tight labor market. Weekly initial jobless claims rose slightly to 220,000 in the week ended October 22, with companies reluctant to lay off workers. The consensus among economists is that corporate record profits are enabling companies to retain workers, despite their higher costs.

In fact, their record profits may be a sign of profit-taking, companies (like the oil giants) making excessive profits on the rising demand for their products.

It is not yet a given that growth will remain positive in the fourth quarter, or that inflation will continue to decline in the face of product shortages (like oil and food), but I am banking on the holidays to bring out shoppers and keep growth positive for the rest of this year.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen