The Federal Reserve is about to raise the overnight interest rate another quarter-percent to 4.5 percent, and hence banks will pass on the increased rate to their borrowers.

So, it shouldn’t be a surprise that this is affecting the lowest income earners’ confidence in their jobs and hence future prospects, i.e., those who borrow most heavily against their incomes.

Will it also bring on a recession if they behave accordingly and stop shopping, since such consumers spend the largest share of their incomes?

Those in the lowest income brackets have been profiting the most from the pandemic-induced shortage of workers until now, but no more, which is reflected in the latest Conference Board’s Confidence Survey that declined slightly from 109 to 107.1.

“Consumer confidence declined in January, but it remains above the level seen last July, lowest in 2022,” said Ataman Ozyildirim, Senior Director, Economics at The Conference Board. “Consumer confidence fell the most for households earning less than $15,000 and for households aged under 35.”

Why? Average hourly wages of all employees are plunging after inflation despite the tight labor market, worsening the wage inequality of those workers that the Fed says it wants most to help.

This was reinforced by the Labor Department’s quarterly Employment Cost Index that measures overall labor costs incurred by employers. It rose less than expected, up 1 percent in Q4, so wage costs are still not keeping up with inflation.

Actual hourly wages and salaries declined 1.2 percent after inflation last year. Wage costs were down 3 percent in September Q3 after inflation, so workers’ incomes have improved since then as inflation has subsided.

But this doesn’t solve the problem of a hyperactive Fed still obsessed with higher wages as the inflation culprit, when it is mostly factors beyond their control causing the stubbornly high inflation rate.

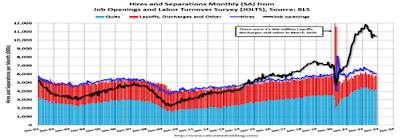

As was discussed in a recent CNBC TV panel, the real culprit is an ongoing labor shortage. One million working-age workers have died, many baby boomers born 1946-64 have retired, and even working-age adults are retiring sooner.

Meanwhile, congress has not yet found a way to solve the immigration problem(s), since the U.S. economy has historically relied upon new immigrants to supply the worker shortfall.

And the Fed keeps looking in the rear view mirror of the 1970s when the inflation rate soared into double digits in an economy constrained by our dependence upon oil and OPEC. But we didn’t have international supply-chains then to cure the supply shortages more quickly, another factor affecting inflation, opined CNBC’s chief economist Steve Liesman in the same panel discussion.

These are all factors beyond the control of the Fed Governors, who only have two tools in their inflation-fighting tool box—interest rates and lots of jawboning to tame the inflation dragon.

So consumers’ confidence in the economy and their future expectations should be another factor the Fed Governors look at, if they want to generate that soft landing everyone is hoping for.

Harlan Green © 2023

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen