Will US economic growth fall off a cliff in January? Maybe not. The Atlanta Federal Reserves’ GDPNow estimate has just raised their estimate of fourth quarter GDP growth to 3.7 percent and it was right on predicting higher Q3 growth.

Yet the pundit chorus is growing for at least two quarters of negative growth in 2023 due to the Fed’s hawkish stance on inflation.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 3.7 percent on December 23, up from 2.7 percent on December 20,” said the GDPNow report.

After recent releases from the US Census Bureau, the US Bureau of Economic Analysis, and the National Association of Realtors, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth increased from 3.4 percent and -0.2 percent, respectively, to 3.6 percent and 3.8 percent, respectively.

One reliable indicator, the Conference Board’s Index of leading Indicators (LEI), is predicting a recession next year.

Ataman Ozyildirim, Senior Director, Economics, at The Conference Board said: “Despite the current resilience of the labor market—as revealed by the US CEI in November—and consumer confidence improving in December, the US LEI suggests the Federal Reserve’s monetary tightening cycle is curtailing aspects of economic activity, especially housing. As a result, we project a US recession is likely to start around the beginning of 2023 and last through mid-year.”

But the jury is still out among economists on what may happen next year. Harvard economist Jeffery Frankel, a leading growth expert, believes it’s not so inevitable in a Project Syndicate column.

“Clearly, the reports that the United States was in recession during the first half of the year were premature, especially given how tight the US labor market is. And, despite the confidence with which many again proclaim the inevitability of a downturn, the chances of one in the coming year are well below 100%.”

In fact, there are too many ‘known unknowns’ to paraphrase Bush Defense Secretary Donald Rumsfeld.

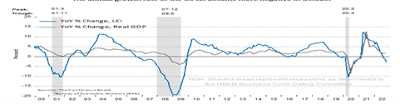

Let’s take the unemployment situation for starters. The unemployment rate is still at post-World War II lows, and 4.9 million jobs were created in 12 months, the fastest jobs recovery since the 1990 “Desert Storm” recession (black line in graph).

Why are we still at fill employment? There were record levels of government spending, to not only to aid the pandemic recovery but modernize our infrastructure, upgrade our healthcare system and the environment. This is New Deal level spending such as brought us out of the Great Depression.

The $1 trillion infrastructure bill is the largest in history. And it was needed since we had just survived the Great Recession that almost repeated the Great Depression as well as a pandemic that killed more than one million Americans.

Government came to the rescue then, as it is doing now.

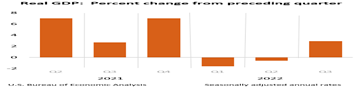

The increase in real GDP for the third quarter reflected increases in exports, consumer spending, nonresidential fixed investment, state and local government spending, and federal government spending, per the BEA.

It will do so again, and we have record corporate profits—still the highest as a percentage of GDP ever.

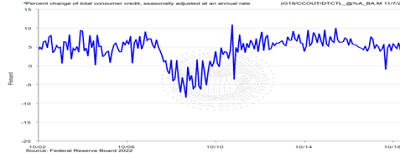

“Consumer confidence bounced back in December, reversing consecutive declines in October and November to reach its highest level since April 2022,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation and Expectations Indexes improved due to consumers’ more favorable view regarding the economy and jobs. Inflation expectations retreated in December to their lowest level since September 2021, with recent declines in gas prices a major impetus. Vacation intentions improved but plans to purchase homes and big-ticket appliances cooled further. “

Consumers, at least, haven’t got the message that a recession is immanent. With so much government support, maybe they see a New Deal in the New Year.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen