Consumers’ financial health continues to improve. They are managing to both save and spend more, in spite of worries about both federal and state deficits. In fact, deficits don’t seem to matter to consumers, at least, as the latest consumer sentiment surveys show consumers’ spirits improving with better job prospects and increasing income.

A little known economic indicator—the Federal Reserve’s monthly report on consumer credit (i.e, outstanding revolving and installment debt, but not mortgages)—shows that consumers are still paying down their credit card debt, but borrowing money for larger loans, like auto and appliances that require a standard monthly payment.

The year-over-year debt to household income measure has fallen from 23.5 to 21.5 percent, while total outstanding credit is still contracting at slightly less then 4 percent per year. Consumer credit rose $1.0 billion in April in a gain far offset by a $7.4 billion downward revision to March which now shows a $5.4 billion contraction. Non-revolving credit, reflecting strong car sales, jumped $9.4 billion in April but was offset by a nearly as large of a fall in revolving credit.

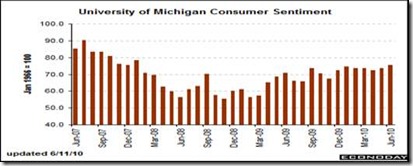

Though retail slowed in May, thanks to a huge drop in building supplies and materials, consumer sentiment rose to 75.5 in the mid-June reading vs. 73.6 at month-end May. The nearly two-point gain is sizable and puts the index at its best level of the year. Gains were posted for both the expectations and current conditions components. Another plus is a definitive fading in inflation expectations, falling an unusually steep 5 tenths in the 12-month outlook to 2.7 percent. Today's report, because of its strength, hints at underlying improvement in the jobs market and should offset the sting from the May retail sales report.

Higher vehicle sales were a pleasant surprise that reinforces strong overall retail sales. Car and truck sales proved very solid in May, at an annual adjusted rate of 11.6 million surpassing April's 11.2 million and ranking alongside March's incentive-driven spike of 11.8 million. Strength was centered in domestic-made trucks which jumped 8.6 percent to a 5.1 million unit pace.

The other pleasant surprise was the continued rise in pending home sales. Already, February and March had spiked with help from last minute buyers wanting to ensure time to close before May 1. But apparently, many buyers decided to push their luck and buy during April in hopes of expedited paperwork by mortgage lenders. Pending home sales extended their surge through April, jumping 6.0 percent, following a 7.1 percent spike in March. Year-on-year, pending home sales are up 22.4 percent.

Harlan Green © 2010

No comments:

Post a Comment