The delinquency rate for mortgage loans on one-to-four-unit residential properties dropped to a seasonally adjusted rate of 9.85 percent of all loans outstanding as of the end of the second quarter of 2010, a decrease of 21 basis points from the first quarter of 2010, and an increase of 61 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. But is it only the recession that explains such horrendous numbers, the worst since the 50 percent default rate of the Depression?

Of course the recent recession and burst housing bubble have contributed to much of the foreclosure problem, but studies by the FDIC have shown deeper, underlying causes. In fact, the foreclosure rate has been rising since the 1970s, when it was as low as 0.2 percent.

“These latest delinquency numbers contain a mixture of somewhat good news and somewhat bad news. The good news is that foreclosure starts are down and the inventory of homes anywhere in the process of foreclosure fell for the first time since 2006 and had the largest drop since 2005. The fact that both the 90+ delinquency rate fell and the foreclosure start rate fell means that a significant number of these seriously delinquent loans have been successfully modified and reclassified as performing, current loans,” said Jay Brinkmann, MBA’s chief economist.

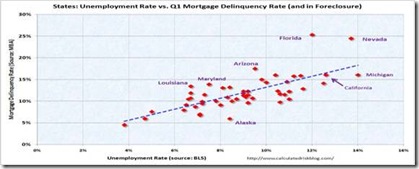

So-called underlying causes are worth studying because many factors go into the foreclosure pot besides the usual reasons of divorce and job loss. And though underlying causes may not directly precipitate a foreclosure, they make economic shocks such as job losses incurred during recessions harder to weather. There is of course a direct correlation between job losses and unemployment. Florida and Nevada with 12 and 14 percent unemployment rates, respectively, also have the highest delinquency rates.

The most obvious underlying trend studied by the FDIC is the rise in loan amounts as a percentage—or loan-to-value (ltv)—of the purchase price. The ltv for new mortgages has risen to almost 80 percent, from as low as 58 percent in the 1950s. This has particularly hurt homeowners whose housing values have plunged during this recession.

Another startling fact is the rise of mortgages not serviced by their lenders—i.e., that have been sold to investors. Today, 60 percent of new mortgages are sold to investors in the so-called secondary markets, when it was below 20 percent in the 1970s, according to the FDIC. This larger percentage of so-called service-released mortgages correlates with higher delinquency rates, probably because the originating lender (who is no longer responsible for servicing the loan) has in many cases loosened their underwriting standards—especially for the no income/no documentation subprime mortgages.

Today on a seasonally adjusted basis, the overall delinquency rate has decreased, driven by decreases in the rate for fixed rate loans and VA loans. However, ARM and FHA loans saw increases this quarter, said the MBA survey. The seasonally adjusted delinquency rate stood at 5.98 percent for prime fixed loans, 13.75 percent for prime ARM loans, 25.19 percent for subprime fixed loans, 29.50 percent for subprime ARM loans, 13.29 percent for FHA loans, and 7.79 percent for VA loans.

“Ultimately the housing story, whether it is delinquencies, homes sales or housing starts, is an employment story. Only when we see a consistent increase in employment will we see an increase in sales and starts, and a sustained improvement in the delinquency numbers. Until we see the increase in the number of households that comes with an increase in the number of paychecks, all measures of the health of the housing industry will continue to be weak,” said MBA’s Brinkmann.

The study’s conclusion is that “shocks to individual lifestyles or “trigger events,” such as divorce or job loss, have increased the risk of default. But “…the (overall) risk posture of individuals has increased, especially as individuals increasingly leverage their homes as part of a broader strategy of managing their overall wealth portfolio.”

And though during good times such underlying factors may not surface as proximate causes, they increase the risk of foreclosure during economic downturns.

Harlan Green © 2010

No comments:

Post a Comment