The Mortgage Corner

There is still hope that housing may help this economic recovery, as it has in past recoveries. But that is only if Fed Chairman Janet Yellen succeeds in keeping interest rates—mortgage rates in particular—at their current low, or even lower as they were last spring.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 4.9 percent to a seasonally adjusted annual rate of 4.89 million in May from an upwardly-revised 4.66 million in April, according to the National Association of Realtors, but remain 5.0 percent below the 5.15 million-unit level in May 2013.

This means interest rates do affect housing sales. April 2013 was the last month for record low conforming rates, before then Fed Chairman Bernanke announced the Fed would begin to ‘taper’ their $85 billion per month QE3 purchase of Treasury and mortgage-backed securities that helped housing prices begin their rebound from the Great Recession.

There had been a flurry of refinance business and purchase transactions until then, as homeowners scrambled to take advantage of 3.25 to 3.50 percent fixed rates for conforming loan amounts insured by Fannie Mae or Freddie Mac.

Further evidence the reduction in QE3 purchases drove up interest rates is that the overall decline in originations has been led by the refinancing index, which declined by 74.5 percent (dotted red line in graph) since the week of May 3, 2013 and the announcement of the tapering (which actually didn’t begin until fall 2013), while the purchase index has declined by 19 percent.

But housing prices are still rising, as the April S&P/Case-Shiller 20-city composite measure of home prices rose 1.1 percent in April, though the year-on-year gains decelerated to 10.8 percent, according to data released today. Las Vegas and San Francisco led the way with + 18 percent increases, and San Diego, Detroit and Miami were close behind with 15 percent annual increases.

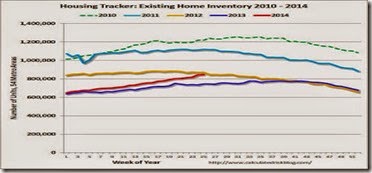

Another reason that prices rises are slowing (other than from higher mortgage rates) may also be that housing inventories are surging. Inventory in 2014 (Red) is now 13.6 percent above the same week in 2013, as reported by Ben at Housing Tracker (Department of Numbers).

So what has to happen to maintain the housing recovery? It looks like mortgage rates must stay at their current level. Today, the 30-year conforming fixed rate is back down to 4 percent for 0 origination points in California, at least. This is mainly thanks to Janet Yellen, who keeps maintaining that rates have to stay low long enough to create jobs for the long term unemployed.

She can do this because she is an authentic macro economist, one who understands how our real economy works in order to put people back to work. This may be the first time that a Fed Chairman has said full employment is more important than bankers’ worry about inflation (which is still nonexistent, by the way).

In fact, full employment is the cure that will bring back household income, and pay down the federal debt, something that real economists know, but that bankers and corporate executives seem to have forgotten.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment