The Mortgage Corner

Housing starts are being hit by huge swings. November starts fell 18.7 percent in November to a much lower-than-expected 1.090 million annualized rate following an upward revised gain of 27.4 percent to 1.340 million in October, says Econoday. But that’s to be expected with winter weather already hitting the Midwest and eastern states.

This is while interest rates have barely budged since the Fed raised its short term rates 0.25 percent to s range of 0.50 to 0.75 percent. That’s why housing construction and builder sentiment remain strong. The 30-year conforming fixed rate remains below 4 percent--@3.875 percent for one origination point (i.e., one percent) in California.

And existing-home sales are at record highs for this cycle. Existing-home sales ran at a seasonally adjusted annual 5.61 million pace, the National Association of Realtors said Thursday. That was up 0.7 percent from a downwardly-revised pace of 5.57 million in October and marks the highest since February 2007.

Lawrence Yun, NAR chief economist, says it's been an outstanding three-month stretch for the housing market as 2016 nears the finish line. "The healthiest job market since the Great Recession and the anticipation of some buyers to close on a home before mortgage rates accurately rose from their historically low level have combined to drive sales higher in recent months," he said. "Furthermore, it's no coincidence that home shoppers in the Northeast — where price growth has been tame all year — had the most success last month."November’s existing sales rate was 15.4 percent higher compared to a year ago, the first month when new regulations, known as the “Know Before You Owe”, or TRID disclosures that added extra days to disclosure times went into effect, snarling closing times.

Single-family starts fell 4.1 percent in November to a seasonally adjusted

annual rate of 828,000 units while multifamily production dropped 45.1 percent

to 262,000 units. However, the best news in the report is a 15.4 percent gain in

housing completions to a 1.216 million rate which follows a 6.3 percent jump in

the prior month. Houses authorized but not started are also up, 3.0 percent

higher to 138,000. Gains here will help ease what is very tight supply for new

homes.

The Mortgage Corner

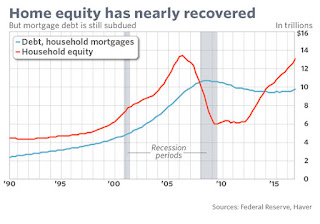

“Single-family starts declined from a robust level in October but still remain very solid,” said NAHB Chief Economist Robert Dietz. “Though rising mortgage rates could be a headwind for housing, we expect single-family production to continue on a long-run, gradual growth trend. Meanwhile, the multifamily sector, which has been volatile in recent months, is expected to level off at a solid rate as that market finds balance between supply and demand.”Rising household wealth is one reason housing sales have returned to 2007 levels, as household net worth rose to a new all-time high and home equity rose to just a hair below its level in 2006, before the housing bubble burst, said the Federal Reserve in its quarterly flow of funds report.

NAR Chief Economist Lawrence Yun believes housing sales could go even higher if housing starts continue to increase. The “big obstacle,” said Yun, is the ongoing “housing shortage,” which is pushing prices to record levels, as well. There were 4.0 months of supply at the current pace of sales, the 18th month in which inventory was tighter compared to its level a year ago.”Rising household wealth is one reason housing sales have returned to 2007 levels, as household net worth rose to a new all-time high and home equity rose to just a hair below its level in 2006, before the housing bubble burst, said the Federal Reserve in its quarterly flow of funds report.

But inflation is on the rise, which will boost housing prices further and perhaps encourage more construction, as well. The median existing-home price across the country was $234,900, up 6.8 percent compared to November 2015. This means those with little or no equity in their homes will see their financial position improve, thus adding to future economic growth.

Harlan Green © 2016

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment