Real estate is the industry most affected by rising interest rates, so it’s encouraging to see that housing sales are showing signs of a revival. Both new-home and pending home sales jumped in January, even with still expensive mortgage rates.

One reason: builders are buying down those mortgage rates.

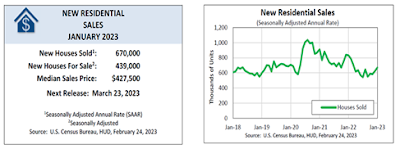

Sales of newly built, single-family homes in January increased 7.2 percent to a 670,000 seasonally adjusted annual rate from an upwardly revised reading in December, according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

And it’s not that expensive for a builder to offer an affordable mortgage rate—just 4 points (%) to buy down a conforming 30-year fixed rate mortgage to 4.875%; not that much to tack onto a sales price.

“The latest HMI survey shows 57% of builders are using incentives to bolster sales, including providing mortgage rate buy-downs, paying points for buyers and offering price reductions,” said Alicia Huey, chairman of the National Association of Home Builders (NAHB). “Buyer incentives, along with stabilizing mortgage rates during the month of January, increased the pace of new home sales for the month. However, in a sign of current market weakness, sales are down 19.4% compared to a year ago.”

Pending home sales also improved in January for the second consecutive month, according to the National Association of RealtorsÒ.

The Pending Home Sales Index (PHSI)* — a forward-looking indicator of home sales based on contract signings — improved 8.1 percent to 82.5 in January. (But) Year-over-year, pending transactions dropped by 24.1 percent.

“Buyers responded to better affordability from falling mortgage rates in December and January,” said NAR Chief Economist Lawrence Yun.

What is causing more optimism among homebuyers? Builders are seeing more traffic from new-home wannabes, for starters.

The National Association of Builders reports two consecutive solid monthly gains for builder confidence, spurred in part by easing mortgage rates, signal that the housing market may be turning a corner even as builders continue to contend with high construction costs and building material supply chain logjams.

A more immediate reason for the improvements is an acute housing shortage. Builders essentially stopped building new homes for a decade after the Great Recession and busted housing bubble.

“With the largest monthly increase for builder sentiment since June 2013, excluding the period immediately after the onset of the pandemic, the HMI indicates that incremental gains for housing affordability have the ability to price-in buyers to the market,” said NAHB Chairman Alicia Huey. “The nation continues to face a sizeable housing shortage that can only be closed by building more affordable, attainable housing.”

The NAR anticipates the economy will continue to add jobs throughout 2023 and 2024, with the 30-year fixed mortgage rate steadily dropping to an average of 6.1% in 2023 and 5.4% in 2024.

Most prospective homebuyers are still on the sidelines, however. The Conference Board reported a further decline in consumer confidence reflecting large drops in confidence for households aged 35 to 54 and for households earning $35,000 or more,” said Ataman Ozyildirim, Senior Director, Economics at The Conference Board.

“While consumers’ view of current business conditions worsened in February, the Present Situation Index still ticked up slightly based on a more favorable view of the availability of jobs. In fact, the proportion of consumers saying jobs are ‘plentiful’ climbed to 52.0 percent—back to levels seen in the spring of last year.”

So what are homebuyers to do? Should they look for homebuilders willing to buy down that mortgage to 4.875%, or wait while housing prices continue to climb?

Harlan Green © 2023

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment