In the light of the recent bank failures, and the Fed’s own missteps in fighting inflation, history is telling us that the Fed’s current 2 percent target rate for inflation is too low.

Why? Because Federal Reserve policy since the 1970s has mostly benefited banks and other financial institutions that manage money.

It’s easy to see why. The Fed is in charge of keeping our banking system sound, which is implied in its mandate to maintain price stability and maximum employment. So its primary focus has always been to defend the value of their assets, and inflation diminishes asset values.

But the Fed hasn’t maintained price stability as evidenced by the recent inflation surge and was surprised by three US bank failures, causing doubts as to the soundness of our banking system.

Former FDIC Chairman Sheila Bair highlighted the dangers of such inattention in a MarketWatch interview.

“This is a risk confronting all banks,” she said. “All examiners need to be on alert for how interest-rate risk is being managed. If there is a run, they will need to sell these securities. Those are the kinds of things all-size banks, and all examiners should be worried about in our banking system."

Current monetary policy has not improved workers’ wages, either, which haven’t kept up with inflation with the wild gyrations caused by the COVID pandemic and some $6 trillion in pandemic aid.

So isn’t it time for Fed monetary policies to focus on bringing down the record income inequality that has prevailed since then and ranked US income inequality the same as Haiti, far below that of other developed countries. per the CIA’s World-Factbook?

Why do we have red and blue states and a divided country, otherwise? Many Americans feel disenfranchised who no longer have jobs that earn what they did in the 1970s when we still had a manufacturing base in the rust belt.

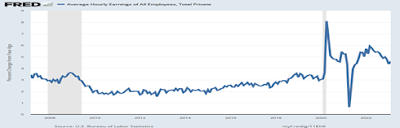

The average hourly earnings of employees has never risen above the 2-3 percent range, per the St. Louis Fed’s above graph of average hourly wages dating from the 2008 Great Recession.

Chairman Powell was explicit in his press conference after the conclusion of the latest FOMC meeting, at which another 0.25 percent rate increase was announced. The labor market is still too hot, he said, and has caused wage growth to accelerate rather than decline, which the Fed deemed was necessary to bring down inflation.

So employees’ earnings have now become the culprit keeping inflation too high, when the latest research has shown excess corporate profits and the Ukraine war jump-started the current inflation surge.

In other words, the Fed has been most successful at keeping employees’ wages at or below the inflation rate since the 1970s as they labored to keep inflation in the 2 percent target range.

This is not a coincidence. Fed Governors since former Fed Chair Paul Volcker have believed conditions that prevailed since the 1970s still rule that caused the wage-price spiral and double-digit inflation of that time.

But globalization policies expanded world trade and developed just-in-time supply-chains that brought in cheaper consumer goods and exported manufacturing jobs to low wage-earning countries. Inflation became so tame during the 1990s that it was termed the Great Moderation.

So why does our Fed have a 2 percent inflation target?

Progressive labor economist Jared Bernstein opined on this matter in the Washington Post shortly after Fed Chairman Bernanke first announced the Fed’s decision to keep a 2 percent inflation target.

“The fact is that the target is 2 percent because the target is 2 percent. Were the target 3 percent or 4 percent, you’d be reasonably asking me, why 3 or 4? To the extent that there’s an anti-inflation bias among economic elites (and thus an anti-full-employment bias), and I think that’s often the case, I’d reiterate arguments I made here…that the debates over full employment and Federal Reserve policy are generally dominated by the interests of the minority who worry more about inflation and asset values than those who worry about jobs and paychecks.”

Is there real evidence the current 4.4-4.6 percent average hourly wage increases employees are enjoying that was reported in the February unemployment report inflationary?

No, average hourly wages could be contributing as little as 8 percent to product costs in one recent paper by EPI economist Josh Bivens that I cited above.

There is much that government can do to lessen income inequality, which would in turn lessen the yawning gap between the Haves and Havenots in this country. The Federal Reserve can do its part by lessening the inherent bias of a low inflation target that mainly targets wage earners, which includes 32 million Americans that still live below the poverty line.

Harlan Green © 2023

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment