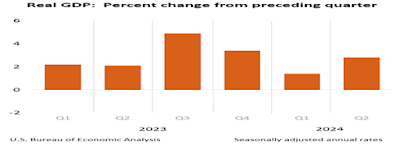

Today’s second quarter Gross Domestic Product (GDP) grew 2.8 percent, double first quarter’s 1.4 percent, which will give a huge boost to confidence that no recession is imminent, but also enough ammunition for the inflation hawks that say inflation is still too high.

This is when the BEA said the price index for gross domestic purchases increased just 2.3 percent in the second quarter, compared with an increase of 3.1 percent in the first quarter. And the personal consumption expenditures (PCE) price index increased just 2.6 percent, compared with an increase of 3.4 percent.

These are declining inflation rates that affect consumers and tell us it’s time for a rate drop. Gas prices have plunged, as have grocery prices.

But I find it worrisome that manufacturing is still faltering. We won’t see a full recovery from the pandemic otherwise, because manufacturing is part of our infrastructure modernization, as well as the CHIPS Act renewal that is bringing back the microchip factories important to our national security.

The services sector is powering our growth at present, which includes health care, leisure and hospitality, and means consumers are still going on vacation, as can be seen from the crowded airports and highways.

MarketWatch’s Jeffry Bartash reports the first reading of the S&P U.S. services index of purchasing managers climbed to a 28-month high of 56.0 in July, from 55.3 in the prior month. Numbers above 50 signal growth.

The service side of the economy — retailers, banks, hospitals and the like — employs most Americans and has driven the expansion since the pandemic, said Bartash.

The preliminary U.S. manufacturing PMI, however, fell to a six-month low of 49.5, dipping back into contraction territory. Manufacturers are even more important today to win the cold war and actual wars that are a major reason authoritarian governments still exist.

What is powering most of the expansion? The Federal Reserve’s consumer credit measure for May—the 2nd month of the second quarter—just showed a big jump in consumer borrowing, I said last week. Total consumer credit rose $11.3 billion in May, up from a $6.5 billion gain in the prior month, per the Federal Reserve.

Consumers’ personal savings have shrunk, which is why they are now even more dependent on credit, and why I’ve been saying such spending can’t continue with the sky-high 8.5 percent Prime Rate translating to 20 percent plus credit card rates.

And how about the housing market? Both existing and new-home sales are declining to post-pandemic lows because of excessively high construction costs and mortgage rates, at a time when we need more housing than ever.

When will the Fed get the message?

Harlan Green © 2024

Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment