No, we are not talking about a double dip recession, or two scoops of ice cream. The much touted double-dip in economic activity has happened—only it was a dip in activity, rather than outright recession. In fact, as many including Alan Greenspan have said; such dips, or ‘troughs’ are common during recoveries. There is an initial burst—such as Q4 2009’s 5+ percent jump in GDP growth—followed by consolidation, as casualties of the recession continue to shed jobs and newer businesses begin to add employees.

The best evidence is that preliminary Q3 GDP growth edged up to 2.0 percent growth from its 1.7 percent trough in Q2 2010. And the Institute for Supply Management’s manufacturing index also jumped after several months of decline. We can therefore expect other sectors—including employment, personal income, the service sector, and even real estate—to pick up in coming months.

The manufacturing sector surged in October led by a burst in new orders and supported by strong employment gains. The composite headline index jumped nearly 2-1/2 points to 56.9. New Orders are the standout, up nearly eight points to 58.9 to indicate strong month-to-month growth for the best reading since May. Employment rose more than one point to 57.7 indicating no let up in hiring.

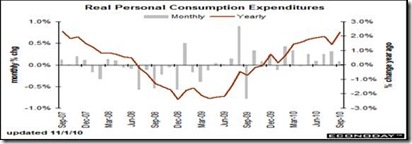

Personal income and expenditures (PCE) also seem to be coming out of their doldrums. Personal income’s trough was in June. It slipped again in September, following a 0.4 percent boost in August, but was still positive. Weakness was led by a sharp drop in government unemployment insurance benefits, rather than the private sector, where incomes are again expanding.

Spending was also positive in September. Personal spending rose 0.2 percent, following a 0.5 percent jump in August. By components, durables jumped 0.7 percent, nondurables rose 0.1 percent, and services edged up 0.1 percent. Annual PCE growth increased to 3.7 percent in September from 2.8 percent in August.

While the consumer sector is still slow, we are seeing improvement in construction and manufacturing today. Construction spending rebounded in September, gaining 0.5 percent after a 0.2 percent dip the month before. The boost in September was led by a 1.8 percent increase in private residential outlays, following a 4.2 percent decline in August. These numbers reflect recent improvement in housing starts. Also, public outlays advanced 1.3 percent after a 2.2 percent rise in August. So, we may finally be seeing some of the effects of fiscal stimulus in gains in public construction.

The double dip fears weren’t propagated because pundits had any evidence there would be a double recession. Rather, conservative economists in particular conjectured—with no basis in fact—that employers were holding back on investments and hiring because of too much government. You can name their pet peeves—the health care or Dodd-Frank bills that required health insurance for all and put new regulations on the financial industry, including consumer protections.

It is hard to believe that corporate CEOs, known for their hard-headedness, would act on a result that might happen in 4 years, which is when most of those provisions kick in. In fact, the Consumer Protection Act has yet to be fleshed out, so no one currently knows its effects.

But we can see the result of such unfounded conjecture. It has affected consumer confidence, which is still experiencing the double-dip, though much above its 2009 lows.

So it is more likely that most of the double-dip talk was because of the political season. They were more likely attempts, in other words, to sway opinion and install fears in those unsettled by these unsettled times.

Harlan Green © 2010

No comments:

Post a Comment