Popular Economics Weekly

Fed Chair Janet Yellen has given us a very good holiday gift. that boosted stock and bond prices. She announced at her post-FOMC meeting press conference that Fed Governor’s see little or no inflation next year. In fact, if falling prices continue in the rest of the world, the Fed may be tempted to not raise interest rates at all next year.

That is a startling conclusion, but she made particular mention of the effects of falling oil prices. They will of course help consumer spending in the developed countries, but the oil exporting countries will be hurt. And lower oil prices also mean less oil is being used, so there is less worldwide demand for energy-based products and services, which means less business activity in general.

“At this point we think it unlikely that it will be appropriate that we will see conditions for at least the next couple of meetings that will make it appropriate for us to decide to begin normalization,” Yellen said at the press conference. The bank’s policymakers meet next in late January again in mid-March, and at the end of April. Most pundits and forecasters say the Fed isn’t likely to change policies until their April meeting, at the earliest.

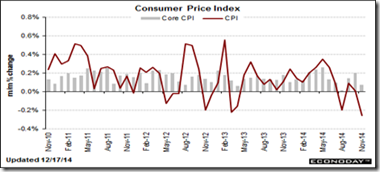

Consumer price inflation turned down in November on sharply lower gasoline prices plus dips in some core subcomponents. Overall consumer price inflation fell 0.3 percent after no change in October. Energy dropped 3.8 percent, following a 1.9 percent decline the month before. Gasoline plunged 6.6 percent in November after a 3.0 drop in October.

Excluding food and energy, consumer price inflation posted at 0.1 percent in November easing from 0.2 percent in October. The Fed’s own target inflation rates were lowered to 1.0 to 1.6 percent in 2015. Within the core, the shelter index rose 0.3 percent, and the indexes for medical care, airline fares, and alcoholic beverages also rose. In contrast, the indexes for apparel, used cars and trucks, recreation, household furnishings and operations, personal care, and new vehicles all declined in November.

There are others of the same opinion that rates may not rise at all next year. Nobelist Paul Krugman, for instance, has said, “Basically, while (U.S) growth and job creation have finally been pretty good lately, there is so far no sign whatever that the economy is overheating. Core inflation remains below the Fed’s target (the Fed focuses on a different measure that usually runs lower than the CPI, so this report is actually fairly far below target.)

“Add to this troubles abroad — the direct spillover from Russia or even Europe is fairly small, but the rising dollar means that good news on manufacturing may not last — and there is a real risk that any rate hike will turn out to have been a mistake. And it’s a mistake that would be very costly, because it could all too easily set the stage for a Japan/Europe style long-term low-inflation trap (yes, at this point I think we can put the euro area in the same category).”

We also have record high consumer sentiment, which is boosting retail sales, for one. The expectations component that offers an indication on confidence in the outlook for jobs and income, is up 3 tenths from mid-month and up a very strong 6.5 points from final November. Inflation expectations are very soft reflecting the downdraft underway in oil prices with both the 1-year and 5-year outlooks at 2.8 percent. Today's report will be especially pleasant reading for the nation's retailers.

That should also mean longer term mortgage rates could remain low next year, bringing even more buyers into the housing market (read younger millennial buyers currently renters) and so contributing to the housing recovery.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment