The Mortgage Corner

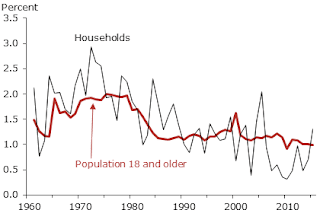

The growth in household formation, the major determinate of home ownership, is slowly returning to pre-housing bubble levels, according to a 2016 report by the San Francisco Fed’s economic research dept. This is a good sign for the future of new home construction as well, that has run a deep deficit since the end of the housing bubble.

The culprit in large part has been a millennial generation reaching adulthood—those born 1981 to 1996—that have been slow to leave home and form their own households, burdened with student debt and a slow to recover job market since the end of the Great Recession.

In 2014, the U.S. Federal Reserve released data about young households under the age of 35, (millennials), and perhaps one of the most striking data points was the low level of income. The median pre-tax income level for heads-of-household below the age of 35 was $35,300 per year. Comparable levels of income for previous years of the same demographic were $38,900 in 1995 and $43,900 in 2001 (all priced in 2013 dollars so we are looking at an apples-to-apples analysis).

“The shares of young adults heading households now are similar to rates seen at the start of the housing boom,” said the SF Fed researchers. “Moreover, while more young adults are living at home longer, data suggest they are continuing to transition to higher headship rates as they get older…Given current 12-month annual headship rates by age group, the Census Bureau projections imply household formations averaging on the order of 1.4 to 1.5 million per year through 2020. That compares favorably to an average of a little less than 900,000 annually over the past five years.”This could be boosting new-home sales, which eventually boosts housing construction. Sales of newly built, single-family homes jumped 16.9 percent to a seasonally adjusted annual rate of 657,000 units in November after an upwardly revised October report, reports the NAHB, and according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. This is the highest sales pace since March 2018. However, on a year-to-date basis, sales are down 7.7 percent from this time in 2017.

Even builders recognize they are dependent on new household formation. “Solid job growth and growing household formations should support future demand for housing even as builders continue to address mounting affordability woes,” said NAHB Chief Economist Robert Dietz. “Builders are doing all they can to hold the line on costs to meet this demand, particularly at the entry-level market.”Existing-home sales aren’t doing so well. Existing-home sales ran at a seasonally adjusted annual rate of 4.99 million in December, the National Association of Realtors said Tuesday. That was the lowest since November 2015. Sales were down 6.4 percent for the month, and 10.3 percent lower than the year-ago rate.

Lawrence Yun, NAR’s chief economist, says current housing numbers are partly a result of higher interest rates during much of 2018. “The housing market is obviously very sensitive to mortgage rates. Softer sales in December reflected consumer search processes and contract signing activity in previous months when mortgage rates were higher than today. Now, with mortgage rates lower, some revival in home sales is expected going into spring.”But there is also the problem low inventory. There was just a 3.7 months of unsold inventory at the current sales rate. This is much too low to sustain sales anywhere near normal rates, especially in the affordable range. “…there is still a lack of adequate inventory on the lower-priced points and too many in upper-priced points,” said Yun.

We therefore maybe seeing the end of a not so virtuous circle. A fully-employed economy is drawing more millennials to form households and purchase homes. It’s about time, as the oldest cohort of millennials are approaching 38 years of age.

And reinforcing the good news on the household formation front is that more millennial women are marrying—some 1.2 million were newly-weds in 2016, according to PEW Research. That means even more households are being formed

Harlan Green © 2019

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment