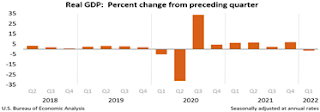

The panic selling in financial markets of late is in part because first quarter 2022 GDP growth contracted after last year’s huge 5.6 percent growth surge, triggering worries of an imminent recession.

The U.S. economy shrank by a 1.5 percent annual rate in Q1, new government figures show, largely because of a record trade deficit. And corporate profits fell for the first time in five quarters.

But corporate profits are still at record levels, up 12.5 percent YoY, and GDP is still growing 10.5 percent annually. So quarterly statistics that financial markets follow can fluctuate wildly, which isn’t very helpful in looking at longer term trends.

The BEA attributes the first quarter decline in GDP to temporary factors and most economists predict a second quarter resumption in economic activity.

“In the first quarter, an increase in COVID-19 cases related to the Omicron variant resulted in continued restrictions and disruptions in the operations of establishments in some parts of the country,” said the BEA. “Government assistance payments in the form of forgivable loans to businesses, grants to state and local governments, and social benefits to households all decreased as provisions of several federal programs expired or tapered off.”.

In fact, the non-partisan Congressional Budget Office (CBO) that ‘scores’ current legislation for its effect on economic activity said U.S. economic growth will exceed 3 percent in 2022, while “roaring inflation has topped and will cool each month to around 2 percent by some point in 2024,” according to a government forecast published Wednesday.

The CBO estimated that real gross domestic product, or GDP, will be driven by consumer spending and demand for services, according to the report. It revised its estimates for GDP growth in 2023 and 2024 upward to 2.2 percent and 1.5 percent, respectively.

“In CBO’s projections, the current economic expansion continues, and economic output grows rapidly over the next year,” the CBO said in its report. “To fulfill the elevated demand for goods and services, businesses increase both investment and hiring, although supply disruptions hinder that growth in 2022.”

One reason the CBO has become more optimistic about stronger growth—the shrinking budget deficit from increased activity.

The U.S. budget deficit will shrink dramatically to $1.036 trillion for fiscal 2022 from $2.775 trillion last year as a strong recovery prompts a surge in revenues and lower outlays, but slowing growth will start to reverse the trend due to higher inflation and rising interest rates, the Congressional Budget Office said.

U.S. corporations are making record profits as a percentage of GDP—in fact, the highest profits since World War Two, per the St Louis FRED historical graph from 1950 that I discussed in my last blog. During the pandemic it dropped briefly to 8 percent of GDP, but quickly rose to its current 11.2 percent, the best on record.

And consumers are still shopping as if there’s no tomorrow that make up some 70 percent of economic activity. So once again, why should investors be held hostage by shorter-term, quarterly projections that only become valid over the longer term, anyway?

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment