Inflation hawks that keep calling for more Fed rate hikes see a recession coming. But what if inflation is already beginning to decline?

The rate of inflation over the past year was unchanged at 6.3 percent in May. The yearly rate has backed off a little after touching a 40-year high a few months ago.

But the core rate of inflation that omits more volatile food and energy prices slowed to 4.7 percent in the 12 months ended in May from 4.9 percent in April and a 40-year high of 5.2 percent in March. What’s more, the inflation readings in the core PCE rate from February through May were the smallest since the end of 2020, reports the BEA.

This is huge folks, as households spent less and even the more volatile food and energy prices are subsiding. Consumers do know how to self-correct. They buy less and travel less with such high inflation, thus reducing the demand that elevates prices.

Meanwhile manufactures are upping their capital expenditures instead of cutting back for fear of a slowdown in economic growth.

Their so-called capital expenditures are up 13.9 percent in a year, a volume not seen since the 1980s, in a sign that supply bottlenecks are easing.

One reason is orders at U.S. factories for long-lasting goods such as new cars or heavy machinery rose 0.7 percent in May, a stronger than expected reading that showed manufacturers still had plenty of demand for their products even amid signs the economy was slowing. It was the seventh gain in the last eight months, the government said.

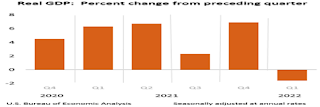

This contrasts with the third and last estimate of Q1 2022 GDP growth that was revised downward to minus -1.6 percent, when it had grown 6.9 percent in last year’s fourth quarter.

The decline in Q1 GDP was mainly due to a massive rise in imports overshadowing a slowdown in exports. Import totals are subtracted from exports in the GDP tally. There was also some reduced consumer spending, as government COVID subsidies have subsided.

But manufacturers and other businesses are restocking their inventories, which will probably boost Q2 economic growth back into the positive column, though economists are uncertain how much.

The surging inflation that is causing so much pain at the gas pump and grocery stores is, after all, a sign of the red-hot growth of consumption outstripping supplies. Many American refineries had also shut down due to decreased consumption during the pandemic and gas prices that hit rock bottom.

Why such wild gyrations in growth? It seems uncertainty over what the Fed will ultimately do to tame inflation is causing the current instability. Will it raise interest rates too high too fast, and cause consumers to close their wallets?

Former Fed Chair Ben Bernanke believes that inflation will not become embedded longer-term, because the ‘70s stagflation was caused by 14 months of rising prices, whereas it has been rising for six months in the current cycle.

One reason for such business optimism is corporations have been reporting record profits, and able to pass most of their increased product costs onto consumers. They are using some of the record profits to hire more workers, because their markets are continuing to expand.

Let’s hope the Fed reads the inflation tea leaves correctly and doesn’t overreact.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment